ETtech

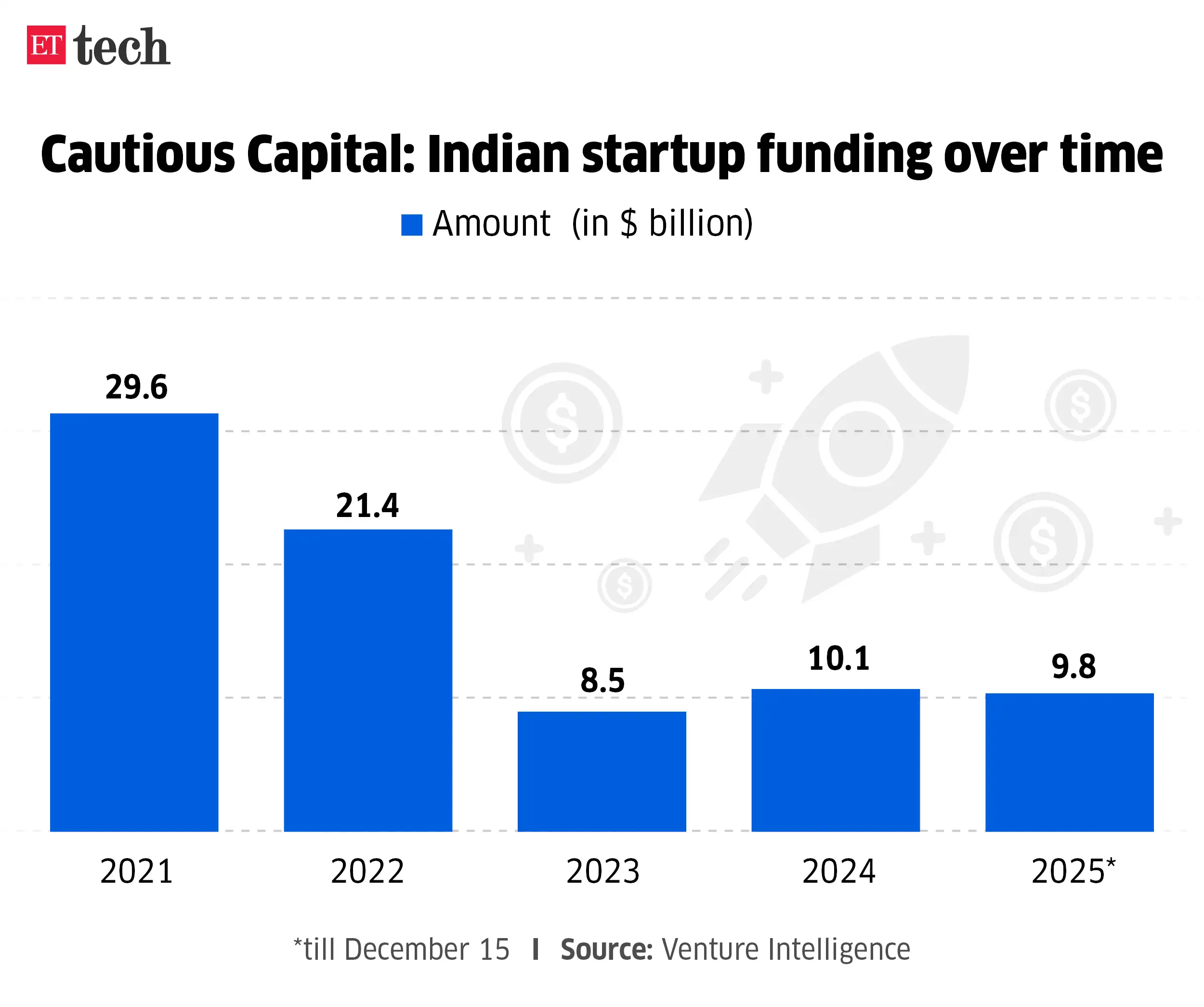

ETtechDespite a pickup in growth-stage funding, funding for Indian startups remained largely stable in 2025 as fewer large deals and changing VC theses on early-stage AI investments weighed on overall numbers. Startups have raised $9.8 billion this year through Dec. 15, slightly lower than the $10.1 billion raised in all of 2024, according to data from Business Intelligence data.

Venture capitalists, however, remained active throughout the year, evaluating early-stage opportunities as exit activity accelerated in a buoyant IPO market.

“There have been two things happening this year. New investments as well as exits. After a few years where the pace had slowed down, thanks to everything related to AI in particular and consumer brands, it’s been quite an eventful year,” said Mohit Bhatnagar, managing director at Peak XV Partners. The investment firm has participated in several growth cycles this year, including a $50 million funding round for the space technology startup Digantara, $65 million for the Truemeds telehealth platform40 million dollars in the fintech startup Scapia as well as AppsForBharat $20 million funding round.

In terms of larger tours, fast trading company Zepto closed a $450 million project in a mix of primary and secondary transactions, while urban mobility startups Rapido closed part of this year of its largest transaction of $550 million. Similarly, e-commerce company Meesho and wealth technology company Groww closed funding of $270 million and $200 million, respectively, for their pre-IPO rounds.

In November, business software startup MoEngage also closed a $280 million funding round comprising both primary and secondary transactions. In a secondary transaction, an incoming investor purchases shares from existing shareholders or employees.

ETtech

ETtech“For companies like ours, fundraising depends a lot on the stage and type of investors you are soliciting from,” said Raviteja Dodda, co-founder and CEO of MoEngage. As a growth-stage company approaches the $1 billion valuation mark, investors increasingly focus on clarity around liquidity, he said.

“At this scale, the path to liquidity has to be very clear, usually an IPO. You can’t plan for an M&A exit at this level,” Dodda said, adding that the strong performance of Indian startup IPOs this year has served as important validation. “With everything that’s happening in the Indian stock markets, it’s a big validation of how large-scale companies can go public when you have high growth and also high profitability.”

Once that validation is established, conversations about fundraising turn to pricing rather than availability of capital, Dodda said, pointing to the visible liquidity and abundance of dry powder among investors amid the ongoing IPO wave. “There is certainly interest in good quality companies. »

Nearly a dozen new age companies have gone public this year, including Meesho, Lenskart, To grow, PhysicsWallah, Pine LaboratoriesHair technologies, Athère Energy, Blue stone and Urban Company – which generates liquidity for early investors.

Early-stage trends

The initial phase, which includes seed and Series A rounds, saw $3.1 billion in funding in 2025, down slightly from $3.5 billion in 2024. This is in stark contrast to a market like the United States, where startups expanding into AI are raising billions of dollars in seed capital.

In India, investors have backed AI startups in enterprise use cases and those targeting developers. Leading investors such as Accel, Lightspeed, Elevation Capital and Capital WestBridge Supported startups focused on AI-driven software integration, DevOps automation, and large-scale adoption platforms.

Rahul Chowdhri, partner, Stellaris Venture Partners who has invested in companies like the startup Insurancetech Pibit.aiAI entertainment startup Dashverse and fintech startup Goodscore, said nearly half of their deal flow this year was AI-native.

“AI will remain a core theme for us, but the opportunity is evolving in a more focused and differentiated way…a specific focus area for us is voice AI. It is emerging as a distinct and growing theme. Given India’s voice-driven behavior and recent technological advancements, voice AI is expected to expand significantly across customer support, sales, marketing, recruiting and logistics,” Chowdhri said.

According to Venture Intelligence, AI and machine learning startups in the enterprise and consumer segments grew this year from $782 million in 2024 to $1.3 billion, even as concerns about a potential global bubble persisted.

“Bubbles are bad for companies that were on shaky sands. But a bubble can’t possibly take away the positive impact of what AI can cause in so many different industries. So I think we’ve been on AI for a long time. And bubbles or no bubbles, I think you’ll see that this is going to be a pretty big area of investment for us over the next decade,” Peak XV’s Bhatnagar said.

This year, Bessemer Venture Partners has invested in companies like Protectbanking infrastructure startup TransbnkPluro, Easebuzz, All Home Bharat Platform, Moxie, short-form learning startup Seekho and Graph AI.

“It’s been an active year for us. We’ve also seen significant participation in many of our businesses. A few clear themes that emerged this year were direct-to-consumer (D2C) brands, AI services and consumer AI. We’ve seen a rapid shift from experimentation to deployment, with AI transforming business and consumer behavior,” said Anant Vidur Puri, Partner at Bessemer Venture Partners.

Late stage loses steam

Late-stage financings, including Series E and F, fell sharply to $1.8 billion in 2025 from $2.9 billion last year as strong IPO activity dampened private market deals, the data showed.

ET earlier reported that Funding for late-stage Indian startups declined in 2025 compared to last year as a busy IPO schedule restricted private market deals for companies. Companies like Lenskart, Groww, PhysicsWallah and Ather Energy have made their IPO debuts, making 2025 one of the most active IPO years for the Indian startup ecosystem since the boom of 2021-22.

“Recent IPOs have created a new generation of experienced operators-turned-founders, bringing deep execution strength to the startup ecosystem. As this pool of high-quality entrepreneurs enters the market, we expect early-stage investment momentum to accelerate,” Chowdhri added.