These two exchange-traded funds are beating the market in 2025 with their concentrated portfolios of AI stocks.

As 2025 draws to a close, now may be a good time for investors to adjust their portfolios in preparation for the new year. The artificial intelligence (AI) sector has been a major source of stock returns this year, and anyone who hasn’t owned a slice of key players like Nvidia And Palantir Technologies likely underperformed relative to benchmark S&P500.

But there is a simple solution for these investors as we approach 2026. Two exchange traded funds (ETFs) that invest exclusively in the booming AI sector are the Roundhill Generative AI and Technology ETF (CAT +0.35%) and the iShares Future AI and Tech ETF (ARTY +0.29%). They take the guesswork out of picking winners and losers. So here’s why they could be great additions to any diversified portfolio in the new year.

Image source: Getty Images.

The case for the Roundhill Generative AI and Technology ETF

The Roundhill ETF invests exclusively in companies developing the infrastructure, platforms and software behind the AI revolution. The fund is actively managed, meaning the Roundhill team regularly adjusts its portfolio to produce the best returns.

The ETF currently holds just 49 stocks, and its top five holdings alone represent 26.7% of the value of its entire portfolio. Although such a degree of concentration can lead to volatility, these five stocks are among the leaders in the AI race:

|

Action |

Roundhill ETF Portfolio Weighting |

|---|---|

|

1. Alphabet |

7.53% |

|

2.Nvidia |

6.11% |

|

3. Microsoft |

5.13% |

|

4. Metaplatforms |

4.28% |

|

5. Palantir Technologies |

3.67% |

Data source: Roundhill. Portfolio weightings are accurate as of December 21, 2025 and are subject to change.

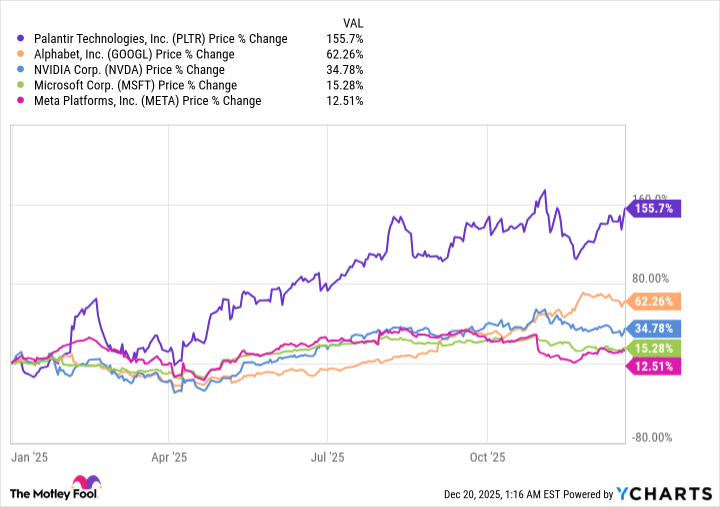

These five stocks returned an average of 56% in 2025, so they helped propel the Roundhill ETF to a 47% year-to-date gain. For some perspective, the S&P500 is up only 17%:

Alphabet just experienced two straight quarters of accelerated revenue growth from its Google search business, almost entirely thanks to new AI-based features like AI previews. Revenue growth in its Google Cloud segment is also accelerating, as the platform races to fill a massive $155 billion backlog from customers waiting for more of its AI data centers to come online.

Many of these data centers are powered by Nvidia’s chips, which set the gold standard for developing AI models. But Alphabet isn’t the only company lining up to buy them: Microsoft and Meta Platforms are also two of the chipmaker’s biggest customers. Meta uses them to advance its open source Llama AI models; Microsoft uses them to deploy its Copilot AI assistant and also sells computing capacity to businesses through its Azure. cloud platform.

Tidal Trust II – Generative AI and Technology ETF Roundhill

Today’s change

(0.35%) $0.21

Current price

$60.88

Key Data Points

Daily scope

$60.13 -$60.95

52 week range

$28.96 -$68.12

Volume

219 KB

Actively managed funds generally have high costs. The Roundhill ETF has a spending rate of 0.75%, while many passive index funds issued by Vanguard, for example, offer expense ratios as low as 0.03%. Fortunately, investors have been well compensated for these costs so far thanks to the Roundhill ETF’s stellar returns since its inception in 2023.

The case of the iShares Future AI and Tech ETF

The iShares ETF invests in AI companies in the United States and around the world. It gives investors exposure to the entire AI value chain, including infrastructure, software and services. The ETF holds 51 stocks, and below are its top five holdings, which represent 23% of its portfolio value:

|

Action |

Weighting of the iShares ETF portfolio |

|---|---|

|

1. Advanced microdevices |

5.48% |

|

2. Vertiv Holdings |

5.25% |

|

3.Nvidia |

4.28% |

|

4. Advantest Corp. |

4.06% |

|

5. Broadcom |

3.96% |

Data source: iShares. Portfolio weightings are accurate as of December 18, 2025 and are subject to change.

Despite a similar orientation to the Roundhill ETF, the composition of the iShares ETF’s top five holdings is quite different. It places more emphasis on providers of data center infrastructure and chips, which have played a central role in the AI boom in recent years.

Advanced Micro Devices is one of Nvidia’s biggest competitors in the data center AI chip market. The company is preparing to launch a new line of graphics processing units (GPU) in 2026 called MI400 series, which could lead the industry in performance.

Broadcom is another major player in this space. It provides an alternative to GPUs called AI accelerators, which are popular among hyperscale customers because they are fully customizable. Broadcom is also a leading provider of networking equipment, which helps regulate the speed at which data flows between chips and devices in AI workloads.

Then there is Vertiv, which is a crucial service provider for data center operators. It offers cooling, power management and networking solutions, and its stock has increased more than tenfold since the AI boom began to gain momentum in early 2023.

iShares Future AI & Tech ETF

Today’s change

(0.29%) $0.14

Current price

$48.32

Key Data Points

Daily scope

$47.75 -$48.33

52 week range

$26:31 -$51.79

Volume

270K

The iShares ETF has an expense ratio of 0.47%, but with a return of 28% this year, it crushes the S&P 500 even after accounting for fees. AI will likely remain a key driver of stock returns in 2026, and investors can get all the exposure they need in this booming sector by adding iShares and Roundhill ETFs to their diversified portfolios.