The new $96 million fund means the Japanese mobile operator has now committed more than $350 million to early-stage investments.

NTT Docomo, Japan’s largest mobile operator, has launched a fourth startup investment fund with capital of approximately $96 million, confirming its commitment to supporting early-stage technology companies.

The fund, with a duration of 10 years, will invest in startups in Japan and abroad, with a view to developing partnerships with these companies which would create new business opportunities for the group.

NTT Docomo has been investing in startups since 2013, when it created its first investment fund of $64 million, followed by a second fund of $96 million in 2017 and a third fund of $96 million in 2022. NTT Docomo Ventures, which manages these funds, has built a portfolio of around 100 companies over the past 12 years and has seen about 50% of these investments withdraw.

Directed by Jun Yasumoto (pictured above) Since 2023, the firm has invested in startups such as Israeli e-commerce fraud prevention company Riskified, which subsequently listed on the New York Stock Exchange in 2021 at a valuation of $3.3 billion, and Swedish industrial IT company Crosser, which was acquired earlier this month by a British rival. More recently, NTT Docomo Ventures has invested in startups focused on cybersecurity, healthcare and AI, including taking a stake in US voice AI startup ElevenLabs.

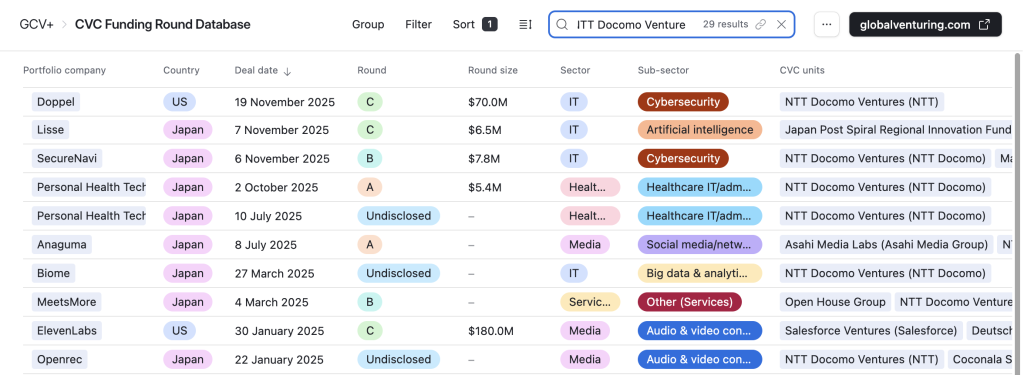

Recent investments by NTT Docomo Ventures in startups

See the full list of venture-backed startup funding rounds in the CVC Funding Cycles Database.

Maija Palmer

Maija Palmer is editor-in-chief of Global Venturing and writes the weekly email newsletter (register here for free).