CapitaLand Investment (SGX:9CI) has announced plans to create a S$260 million automated logistics center in Singapore, with partner Ally Logistic Property operating the facility under a master lease that includes rent increases.

Check out our latest analysis for CapitaLand Investment.

The logistics center announcement comes as momentum picks up, with a 7-day share price return of 5.47% and a 30-day share price return of 11.58%. The 1-year total shareholder return of 25.52% contrasts with a 3-year total shareholder return of 10.12%.

If this kind of real assets story catches your attention, it might be a good time to expand your watchlist and check out fast-growing stocks with high insider ownership.

With CapitaLand Investment trading at S$2.89 and an average analyst price target of S$3.43, the key question is whether the recent share price strength leaves more room for upside, or whether the market is already pricing in future growth.

Most popular story: 15.9% undervalued

The most followed narrative sees CapitaLand Investment’s fair value at S$3.44, which is above the last close of S$2.89, and depends on specific earnings and margin expectations.

The Company’s accelerated capital recycling, exemplified by successful divestments in logistics in India and planned asset sales (over $0.5 billion in China in the second half), combined with redeployment into high-growth sectors of the new economy (such as logistics and data centers), are expected to improve ROI and generate higher portfolio returns, supporting future revenue expansion and net margin improvement.

Curious what kind of earnings growth and profit margins are projected to justify this fair value and future P/E multiple? The narrative relies heavily on fee income, capital recycling and a specific discount rate to achieve this. The details might surprise you.

Result: Fair value of $3.44 (UNDERVALUED)

Read the full story and understand what’s behind the predictions.

However, there is a real risk that slower asset recycling in China, or lower fee income due to tighter fundraising, will make these margin and profit assumptions optimistic.

Discover the main risks linked to this story from CapitaLand Investment.

Another View: Multiples Indicate a Higher Price

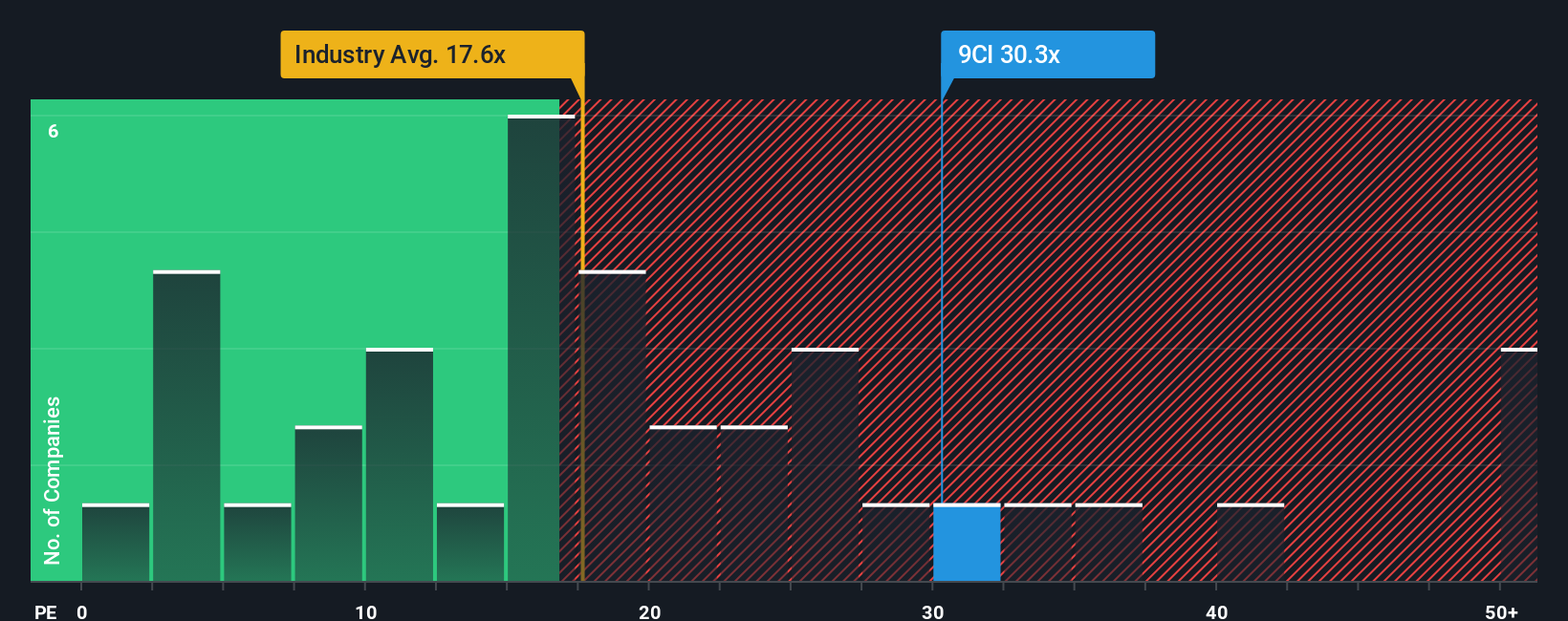

This 15.9% “undervalued” narrative sits poorly next to the current P/E of 33.1x, which is well above SG Real Estate’s industry at 18.3x and its peers at 17.1x. The fair ratio of 23x suggests that the market could get closer to this level. Is the recent optimism already in the prices?

Find out what the numbers say about this price – find out in our review breakdown.

Build your own CapitaLand investment story

If you see the numbers differently or prefer to make your own assumptions, you can create a custom view in just a few minutes starting with Do it your way.

A great starting point for your research into CapitaLand Investment is our analysis highlighting 2 key rewards and 3 important warning signs this could impact your investment decision.

Looking for other investment ideas?

If you stop here, you may miss businesses that better suit your style. Take a few minutes to see what appears on the screener.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to constitute financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your objectives or your financial situation. Our goal is to provide you with targeted, long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Action filter and AI alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend centers (yield of 3% and more)

• Undervalued small caps with insider buying

• High-growth technology and AI companies

Or create your own from 50+ metrics.

Any feedback on this article? Worried about the content? Get in touch with us directly. You can also send an email editorial-team@simplywallst.com