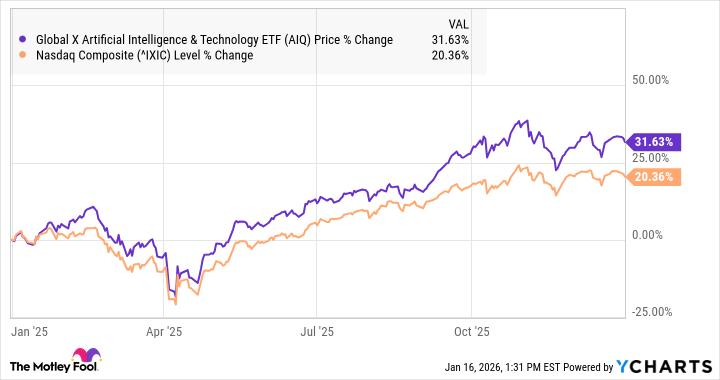

The AIQ ETF has outperformed the Nasdaq for most of the year.

Artificial intelligence (AI) stocks have soared over the past year, and exchange-traded funds (ETFs) focused on AI stocks have surged as well.

One of these ETFs was the Global X Artificial Intelligence and Technology ETF (AIQ 0.04%)a diversified ETF that includes major technology stocks like Samsung (SSNL.F +56.02%), Alphabet (GOOG 0.85%) (GOOGLE 0.83%), Advanced microdevices (AMD +1.79%), Taiwan Semiconductor (TSM +0.22%)And Alibaba.

At the end of the year, the ETFs was up 32%, according to data from S&P Global Market Intelligence. As you can see from the chart below, the ETF has moved similarly to the Nasdaq Compositebut he was ahead for almost the entire year.

Why the AIQ ETF outperformed last

Some ETFs beat the market last year, but AIQ managed to do it without them. volatility which was to be expected, as the fund was ahead of the Nasdaq even when stocks were down in the run-up to the tariff announcement on Liberation Day.

The ETF is sufficiently diversified, with 86 holdings, that no single stock influences the fund significantly. Samsung is currently the largest holding with 5.25% of total assets.

Seventy-two percent of the ETF is comprised of information technology stocks, showing that the fund is primarily comprised of technology stocks, ranging from chipmakers to platforms like Alphabet. You’ll also notice in the top five list that the ETF has significantly more exposure to international stocks than U.S. index funds that track the Nasdaq or S&P500 TO DO. For example, three of the top five stocks are based outside the United States: Samsung, TSMC and Alibaba. SK Hynixa South Korean memory chip maker, is number 7 on the list.

AIQ also has a substantial allocation in the three largest memory chip companies: Samsung, Micron and SK Hynix, all of which had good years last year and appear poised for further gains this year.

The fund attempts to track the Indxx Artificial Intelligence & Big Data index.

Image source: Getty Images.

What to expect for AIQ this year

AI stocks appear to be in a strong position heading into 2026, and many have already advanced so far in the new year. Through January 16, the AIQ was up 3%.

Despite AIQ’s strong growth last year, many of its top holdings still trade at reasonable prices. evaluations. As long as the AI boom continues, AIQ looks to be a winner again this year.

Jeremy Bowman holds positions in Advanced Micro Devices and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions and recommends Advanced Micro Devices, Alphabet and Taiwan Semiconductor Manufacturing. The Mad Motley has a disclosure policy.