Despite a more stable economy, small business owners are still feeling the impact of affordability issues, rising costs and changing government policies heading into 2026.

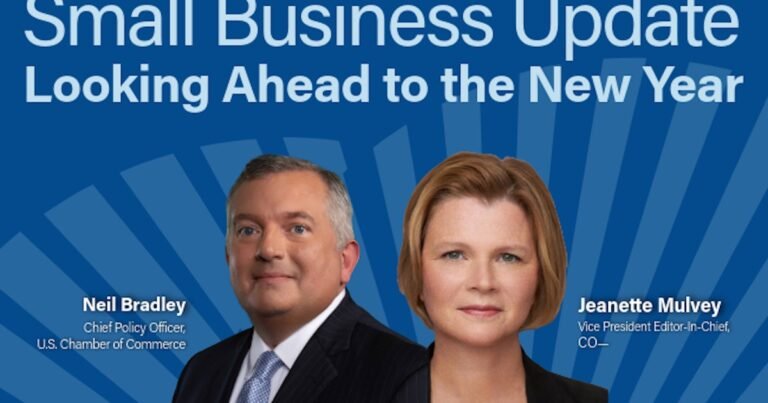

In the first Small Business Update of the year, CO— Editor-in-Chief Jeanette Mulvey spoke with Neil Bradleyexecutive vice president and chief policy officer of the United States Chamber of Commerce, to discuss what entrepreneurs can expect this year. Here are some key trends to watch and how business owners can prepare for the challenges and opportunities ahead.

The economy is growing, but affordability and interest rates remain major concerns.

According to Bradley, the U.S. economy grew slightly above 2% overall in 2025. While this is a good start, he noted that at least 3% growth is needed to support higher wages and household incomes.

“We keep getting these quarterly estimates of where the economy is going…but they diverge wildly,” Bradley said. “When you average all those things, it’s…a little better than 2 percent, but not where we want to be.”

Affordability remains a major concern for small businesses this year. Although inflation has calmed from pandemic highs, it still hovers around 2.7%, above the Federal Reserve’s 2% target. High interest rates will also continue to impact small businesses looking to borrow in 2026. Rate cuts could come later in the year, but Bradley noted that the Federal Reserve is moving cautiously to avoid reigniting inflation.

“We are going to see a slower reduction in interest rates in 2026,” he said. “I think they’re going to stay stable where they are, maybe for the first half of the year before we see … a cut in the Federal Reserve’s interest rate targets.”

(Learn more: 5 Inflation-Fighting Strategies for Small Businesses)

Supreme Court decision on rates could impact reimbursements

Tariffs have been on the minds of many small business owners since early last year. As of this writing, the Supreme Court is considering whether the current administration acted lawfully in using the International Emergency Economic Powers Act (IEEPA) to impose global tariffs.

If the Court declares these tariffs illegal, some could be removed and the companies affected could be entitled to refunds. However, Bradley noted that many tariffs, particularly those on products from China or on metals like steel and aluminum, fall under different laws and would not be affected.

We’re going to see a slower reduction in interest rates in 2026. I think they’re going to stay steady where they are, maybe for the first half of the year before we see… a cut in interest rate targets from the Federal Reserve.

Neil Bradley, Executive Vice President and Chief Policy Officer, United States Chamber of Commerce

(Learn more: Tariff impacts on small businesses)

Tax and immigration policies could affect SME finances and hiring

The major tax reforms voted on as part of the 2025 policy Act on a big and beautiful bill are now in full force. For small businesses, this means more clarity and flexibility deductionsparticularly for R&D expenditure and capital investments.

“Some of the most beneficial provisions are this clarity on your ability to fully deduct your R&D expenses and… your capital investments, your new machinery, your new equipment,” Bradley said. “It’s been made much broader and easier for small businesses. So (if) … you invest in your business, it’s just going to be easier to deduct that from a tax standpoint.”

On the other hand, new immigration restrictions – including a $100,000 fee for H-1B visa and increased visitor requirements – making it harder for small businesses to access legal foreign labor. Bradley pointed to a net reduction in overall migration, which has a profound impact on both the availability of workers and local economic activity.

“There are a lot of communities where immigrant populations make up a significant portion of the consumer base, and all of a sudden you see that trend disappearing,” he said. “This has real consequences for local economies. »

AI Adoption Accelerates, But Federal Regulation Lags

AI continues to be a boon for small business innovation, and Bradley is optimistic about its potential to improve productivity. Although state regulations vary and there is currently no federal policy around this technology, there are many AI resources available to small businesses, such as the U.S. Chamber’s upcoming Virtual AI Training Program, Small Business Basicsin partnership with Google.

“When I talk to small businesses, they are just getting started…and figuring out how to use (AI) to improve their own operations,” Bradley said. “So I think there is a huge opportunity…in 2026, for small businesses to increase their productivity – and that, ultimately, supports a faster growing economy.”

(Learn more: Google and the American Chamber of Commerce join forces to help 40,000 small businesses learn AI)

CO— aims to inspire you from leading, respected experts. However, before making any business decisions, you should consult a professional who can advise you based on your individual situation.

Published