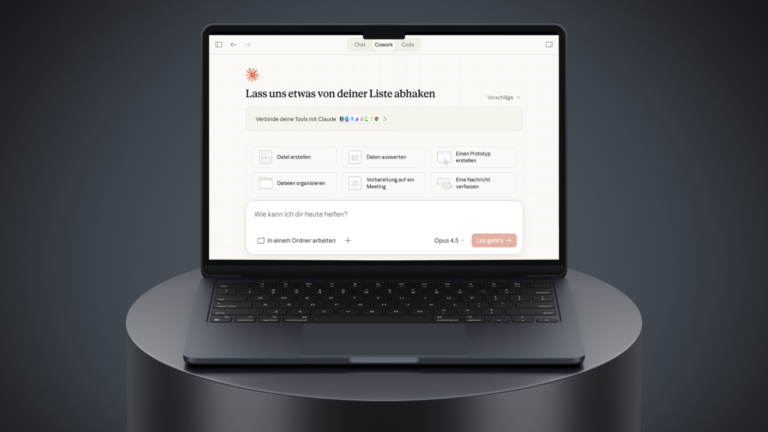

Do we still need software in the future, or is AI enough to handle all kinds of tasks on the computer? The latter possibility is becoming more and more realistic – most recently thanks to the release of Claude Cowork by AI powerhouse Anthropic. Anthropic pitched Cowork, directly connected to its top Claude Series LLMs, as an AI tool that can not only write or create programs, but should generally take care of tedious IT work – from data analysis to drafting legal documents to preparing for meetings.

And this is now sending shock waves through the stock markets, particularly affecting the stocks of SaaS companies that make money in the context of work. Claude Cowork was only presented on January 12, but the effects are already visible. With Wall Street trading near its all-time highs, even Microsoft is struggling with losses.

The company, long the world’s most valuable company, is down 9% year to date in early 2026 and is trading 21% below its yearly high of $555. The ranking of the most valuable companies has changed: Microsoft now ranks only fourth behind Nvidia, Google and Apple. At the same time, major U.S. indexes fell sharply: the tech-heavy Nasdaq Composite lost 1.4 percent, while the broader S&P 500 index fell 0.8 percent.

The trigger for the latest sell-off was in a product announcement made by AI company Anthropic. The company introduced Claude Cowork, a platform that provides AI agents for specific business tasks – including a tool for legal work that automates contract reviews, compliance workflows and legal summaries.

The market reaction was severe: Analytics firms like Gartner and S&P Global fell 21 and 11 percent, respectively, while Intuit and Equifax each lost more than 10 percent. The JPMorgan index of US software stocks fell 7 percent in a single day and has now racked up losses of 18 percent for the current year. The entire software aristocracy – Oracle, Adobe, Salesforce, ServiceNow, DocuSign, Workday and SAP – is in free fall. SAP, Germany’s most valuable company, has lost more than a third of its value from its highs a year ago.

Economic model in crisis

The logic behind inventory losses is clear from the structure of the classic Software-as-a-Service model. For years, revenue was based on user-dependent licenses: more employees meant more desktops and therefore more revenue. This system worked perfectly until AI systems began to replace human labor or at least massively compress it. If autonomous AI agents take on tasks in the future that previously required entire company departments, the question will arise whether dozens of Salesforce or Workday licenses are needed.

If AI reviews, drafts, and closes contracts, the need for DocuSign subscriptions diminishes. And while generative image and design models deliver in seconds what design teams needed, the number of Adobe licenses required is reduced. Investors fear an explosive increase in productivity coupled with a collapse in software vendor revenues. The market hates uncertainty, and a possible shift from user-dependent models to outcome-based pricing could change the entire revenue logic of the industry. Analysts at Mizuho Securities say many institutional investors currently see no reason to own software stocks, regardless of valuation levels or past losses.

Advertising companies were also under pressure because Anthropic also offers marketing automation: Publicis fell 9 percent, WPP almost 12 percent and Omnicom more than 11 percent. Even stock exchange operator LSEG, which generates substantial revenue from its data and information platform Workspace, recorded a decline of 12.8%, its worst daily performance in five years. Private equity firms, which have invested heavily in software in recent years, also suffered significant losses: Ares Management and KKR each fell 10 percent, Apollo 4.8 percent.

Valuations at their lowest in ten years

The current situation presents itself as contradictory: software stocks are trading at ten-year low price-to-earnings ratios, while their fundamentals remain exceptionally strong. Arvy’s fund managers express bemusement at the gap between excellent fundamentals and catastrophic price performance – a phenomenon rarely seen in this form.

Many investors have already reduced their positions in software stocks in recent months, increasing vulnerability to further selling on new developments. Analysts at Irving Investors report that positioning is at multi-year lows, while risks are at multi-year highs. Jones Trading observers point out second-round effects: if software publishers, customers of hyperscalers like Amazon, Microsoft and Alphabet, are disrupted by AI, this also has an impact on the demand for cloud computing power.

The truth probably lies between the extremes. The software industry is experiencing perhaps its greatest phase of transformation since the cloud revolution. AI won’t immediately replace software, but it has the potential to redefine it. Leading vendors have extensive data sets, deep customer relationships, and critical infrastructure. Companies like Microsoft, SAP or Salesforce also generate sufficiently high revenues outside of their classic software business.

SaaS or rather SaaS?

The fact that software could have a difficult future in the AI era was already evident in 2024 and 2025. For example, Klarna had loudly announced that it would do without Salesforce’s CRM cloud and, in the future, also Workday, a cloud provider for accounting, human resources management and business planning (more about this here).

Similar statements came from the world’s largest business software vendor: Charles Lamanna, vice president for business applications and platforms at Microsoft, predicted that traditional business applications would be obsolete by 2030. Instead, AI-based “sales agents” are expected to take the lead (more about this here). Today, with the introduction of Cowork, the first effects of this trend are becoming visible on the stock market.

A new watchword has appeared in this context: Service as a Software. Activities that were traditionally performed by humans as a service are being automated by AI software and “packaged”. Instead of hiring an accountant, translator or customer service employee, we use an AI agent who performs this service independently. The focus is not on the tool, but on the result: you are essentially buying the result of the work, not a tool.