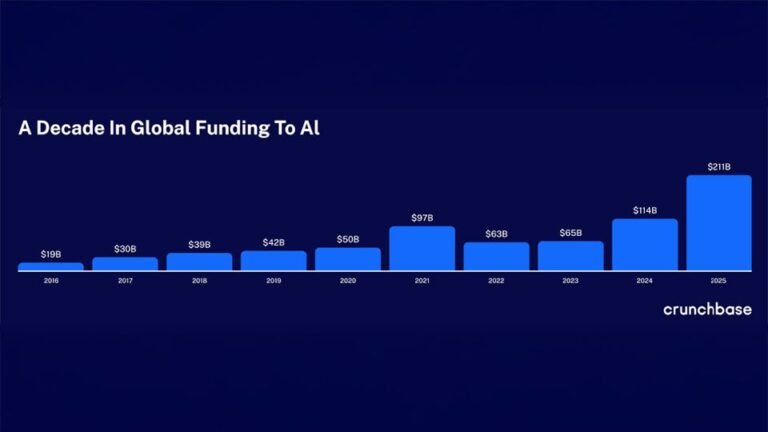

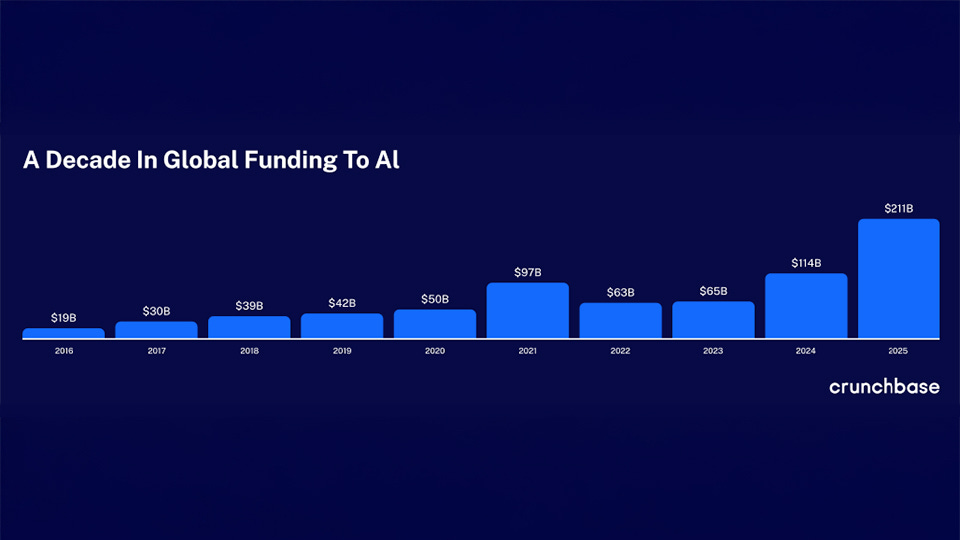

Investors are not showing restraint when it comes to AI. According to new data from Crunchbase and HumanXAI companies raised $211 billion in venture capital last year, an 85% increase from 2024. In other words: one in two venture capital dollars went to AI.

Money is not distributed evenly. Unsurprisingly, it is heavily concentrated in the San Francisco Bay Area, capturing 60%, or $126 billion, of global AI funding, despite accounting for only 22% of total global deals. And in the region, 81% of all startup capital has been allocated to AI companies, an increase of 11 percentage points from 2024.

The blockbuster is coming Anthropic, OpenAI, Join, Perplexityand others have made 2025 a year defined by foundation model giants. But behind these eye-popping numbers – a 180% year-over-year increase to $87 billion – nearly 60% of venture capital investments were deployed in areas seen as where people see the real value of AI. The data reveals that 19% of startup funding went toward AI infrastructure, such as data labeling and cloud services. Eleven percent was allocated to robotics and defense technology. Finally, 15% was allocated to AI-based software, with health and safety being the main sectors.

AI companies co-founded by women are also seeing notable gains. In North America and Europe, they captured a larger share of venture capital investments last year: 47%, or nearly $85 billion, compared to 19%, or $19 billion, in 2024.

That said, the study authors caution against reading too much into the total amount. A handful of unusually large funding rounds by foundation model labs in 2025 have distorted the landscape, they say. Instead, the researchers suggest that a more consistent measure is the proportion of total funding rounds, which has remained around 20% among women-founded companies over the past eight years.

AI capital continues to consolidate in the United States. Crunchbase data shows that 79% of AI funding is invested in US-based companies, an increase of 3% from the previous year. For comparison, investment in the rest of the world increased by almost 67% between 2024 and 2025.

But as mentioned earlier, much of the money spent on AI companies is concentrated in just one part of the United States: the San Francisco Bay Area. Cradle of Silicon Valley and innovation, it would be more surprising if investors chose to invest their capital elsewhere in the country. Still, a closer look at the Bay Area shows how concentrated AI capital has become: Of the $126 billion invested in local startups, $113 billion went to just 92 companies that raised seed rounds of $100 million or more, led by none other than OpenAI, Anthropic, xAI, Scale AI, Anysphere, Thinking Machines Lab, and Safe Superintelligence.

In short, 2025 turned out to be a banner year for AI venture capital, driven by headline-grabbing mega-rounds. But beneath the surface, significant investment continues in areas such as infrastructure and applied sectors. There is indeed an emerging breadth and scale in the AI ecosystem.

That said, what can we expect this year? Crunchbase predicts that we could see more AI company exits, either through public markets or acquisitions. Tracking approximately 6,600 AI companies that have raised more than $3 million since 2023, the company considers more than 2,300 (more than half) “likely or very likely to be acquired.” He also believes 443 are “likely or very likely to be made public.” Crunchbase, however, did not disclose any names nor did it explicitly state that these releases would take place in 2026.

Nonetheless, based on these signals, Crunchbase seems confident of predicting more M&A and IPO activity in the near future.

The release of Crunchbase and HumanX’s AI funding report comes a few months before HumanX holds its second annual conference in (where else?) San Francisco. The AI Gathering brings together policymakers and industry leaders to discuss actionable AI strategies. Organizers boast that more than 130 companies (e.g. Databricks, Cerebras Systems, CoreWeave, Runway, Synthesia, Cohere, Inflection AI, Figma, Chime and Replit) will be featured, having collectively raised more than $72 billion since 2018.

“We see capital flowing to companies that are solving difficult problems with lasting value,” said Stefan Weitz, CEO and co-founder of HumanX, in a statement. “HumanX is the living ecosystem where these founders and backers come together to test their ideas against real-world results. We don’t just share information on a page; we trigger the “collisions” where data turns into action.