The CEO of cybersecurity company Cato Networks believes we are live in an AI bubble – but he still writes checks.

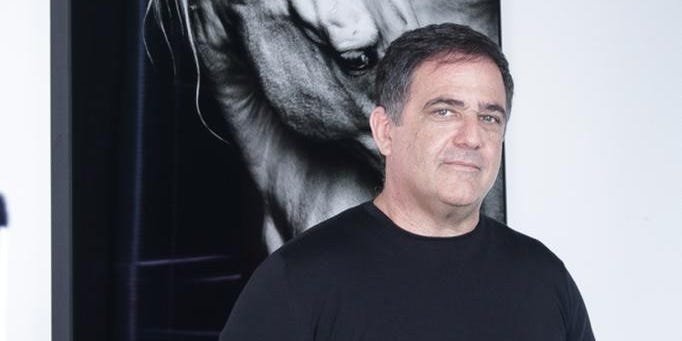

Serial entrepreneur Shlomo Kramer told Business Insider that although Even though the promises of AI are “realizing at a much slower pace” than expected, he still believes in its ability to produce long-term results.

He compared the present moment to Dot-com boom in the late 1990swhich led to the disappearance of many companies.

“There was a lot of damage” said Kramer, who leads the company aimed at securing the digital and AI transformation of organizations. “But e-commerce is obviously a major part of our lives, and so will AI.”

Even though Kramer believes some AI startups are overvalued, he says many of them are also reasonably priced — and he continues to invest in companies he finds promising.

He said every startup needs a “good combination of team, market, product” When evaluating the company’s product, he stated that he was looking for precise criteria that make it a profitable investment.

Check three boxes

Kramer said he looks to check three boxes when evaluating a product.

First, he said it needed a “hook.” The concept should be “quick to understand,” he said, and something he grasps intuitively without having to think about it too much or rationalize it.

“It looks good to me,” Kramer said.

Second, the product should have the potential to evolve into a platform, or at least a “mini-platform” that can expand into something larger over time, the CEO said.

Third, Kramer said the team should have a clear vision of the use cases that will ultimately turn the platform into a monetizable business.

Investment courses

Kramer has made about 67 investments, according to PitchBook, including in several successful enterprise software companies, such as Palo Alto Networks, Gong and Trusteer, which were acquired by IBM. However, he also made mistakes, he said.

Although he says he invests primarily in cybersecurity, he is “intellectually curious” in many areas, which has led him to invest in AI sectors outside of cybersecurity, such as pharmaceuticals and marketing. He said many of these investments in other areas were mistakes, and he acknowledged that it’s “much easier to get excited about things you don’t understand.”

“A deep understanding of something gives you granularity,” Kramer said, adding that enthusiasm usually comes from the big picture.

Kramer said his “perfect startup” is a local app that evolved from a team’s need for a product. He said it’s crucial for entrepreneurs to “really understand the category” the idea is rooted in and understand it from the customer’s perspective.

Kramer said that’s how the first startup he co-founded, Check Point Software Technologies, came to be. He said “the secret sauce” was that Gil Shwed, the former CEO of Check Point, was a systems administrator and understood the customer’s problem, which allowed him to create the right solution.

Check Point’s market capitalization today stands at approximately $18.9 billion, according to PitchBook.