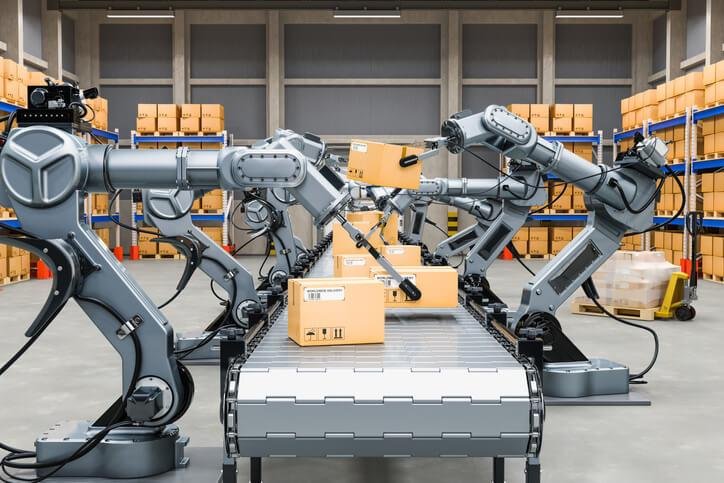

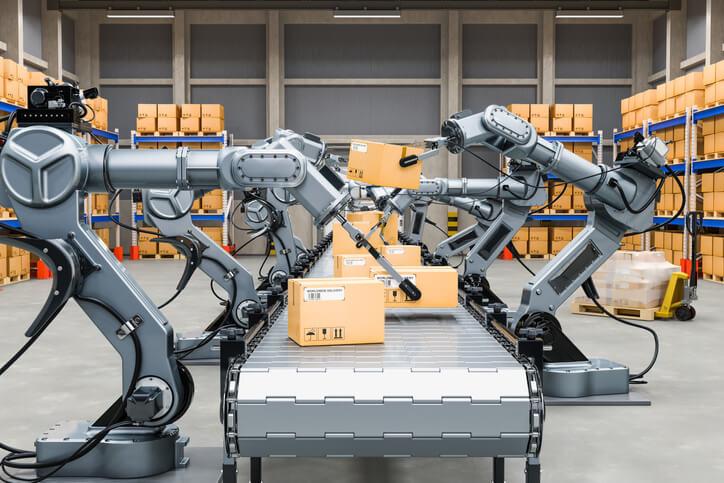

(379 page report) The AI-automated picking systems logistics market addresses the biggest bottleneck in modern warehousing: the physical act of picking individual items from bins. While robots have long been capable of moving heavy pallets, successively picking up a lipstick, a T-shirt and a jar of pickles requires a level of dexterity and visual recognition that machines have historically lacked. This market is exploding thanks to breakthroughs in computer vision and deep reinforcement learning, enabling robotic arms to identify millions of invisible SKUs, determine the optimal grip point, and execute the pick at near-human speed (or faster). Starting in 2026, the industry is moving from Goods-to-Human systems (in which robots bring shelves to humans) to Goods-to-Robot workflows, moving closer to the vision of fully autonomous “dark warehouses.”

Market dynamics and future:

Innovation: Growth is fueled by “Sim2Real” learning, in which robots train in a simulated digital world (attempting millions of inputs on virtual objects overnight) to master complex physics before touching a real product.

Operational change: There is a decisive shift towards “mobile manipulation”, combining autonomous mobile robots (AMR) with robotic arms. These roving robots can navigate to aisles and pick items directly from shelves, eliminating the need for costly fixed conveyor infrastructure.

Distribution: Robotics as a Service (RaaS) is the dominant business model, allowing logistics companies to hire robotic pickers by the hour or on a “pick” basis, thereby shifting costs from CAPEX to OPEX to handle seasonal peaks.

Future Outlook: The market will be defined by general-purpose humanoid robots, which can operate in spaces designed for humans (climbing stairs, reaching high shelves, and handling unstructured tasks) without requiring the rebuilding of the warehouse around them.

Click here, download a free example of this market: https://marketresearchcorridor.com/request-sample/15879/

Analysis of driving factors, constraints, challenges and opportunities:

Market factors:

The Labor Crisis: The logistics industry faces a chronic global shortage of warehouse workers willing to perform repetitive order picking tasks. AI-powered order picking systems provide a reliable, 24/7 workforce that never gets sick or suffers injuries.

Ecommerce SKU Explosion: The “Everything Store” model means warehouses must handle millions of items of different shapes and sizes. Legacy automation (hard-coded for specific elements) fails here; AI-based systems instantly adapt to new packaging.

Speed of delivery: With consumers demanding same-day or one-hour delivery, the selection process must be faster than humanly possible. AI robots minimize “dwell time” and accelerate throughput.

Market Restrictions:

High upfront costs: Despite RaaS models, integrating robotic picking cells requires significant investments in safety cages, grippers, and back-end software integration, which deters small 3PLs.

Handling Limitations: Robots still have difficulty handling heavy, porous, or extremely flexible items (like heavy bags of dog food or baggy clothing), which limits the percentage of inventory that can be fully automated.

Key challenges:

The “Polybag” Problem: Clear, crinkled plastic bags (polybags) used for clothing are the nemesis of computer vision. Developing vision systems that can reliably detect the edges of a crumpled polybag remains a huge technical hurdle.

Brownfield Integration: Deploying robots in messy, old warehouses (“brownfield” sites) with narrow aisles and uneven floors is much more difficult than deploying in purpose-built “greenfield” facilities.

Future Opportunities:

Carrying out shopping: handling fragile items such as eggs or red fruits requires “Soft Robotics” (silicone/air grippers). Mastering this unlocks the huge online grocery market.

Reverse logistics (returns): Using AI picking systems to sort through the chaotic mess of returned items, automatically identifying replenishment quality versus damaged goods.

Learn more about this report: https://marketresearchcorridor.com/schedule-the-call/

Market segmentation:

By component:

Robotic arms (articulated robots, Delta robots)

Forceps/end effectors (vacuum suction cups, finger forceps, soft forceps)

Vision systems (3D cameras, LiDAR)

AI software (grip detection, motion planning)

By technology:

Stationary sampling cells (Goods-to-Robot)

Mobile handling (AMR with arm)

Humanoid robots (bipedal gatherers)

By application:

Parts preparation/order fulfillment

Bin Picking (random selection of bins)

Palletizing and depalletizing

Soration

By end user:

E-commerce and retail

Third-Party Logistics (3PL)

Grocery, food and drinks

Pharmaceuticals and healthcare

Manufacturing

Region:

North America

WE

Canada

Mexico

Europe

UNITED KINGDOM

Germany

France

Italy

Spain

Rest of Europe

Asia-Pacific

China

India

Japan

South Korea

Australia

Rest of Asia Pacific

South America

Brazil

Argentina

Rest of South America

Middle East and Africa

Saudi Arabia

United Arab Emirates

Egypt

South Africa

Rest of the Middle East and Africa

Competitive landscape:

Leading innovators in robotics and AI vision:

Covariant (AI brain for robots)

RightHand Robotics (Parts Selection Specialist)

Berkshire Gray (corporate execution)

Plus One Robotics (vision software)

Osaro (Machine Learning for Industrial Automation)

Mujin (movement planning)

Giants of industrial robotics:

ABB

KUKA AG

Fanuc Corporation

Yaskawa Electric

Universal robots (Cobots)

Emerging humanoid players:

Robotic Agility (Figures)

Figure AI

Apptronik

Regional trends:

The global market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

North America (Venture Capital Hub): dominates the market, driven by the Amazon effect. Amazon Robotics sets the pace, forcing its competitors (Walmart, Target, FedEx) to invest heavily in startups like Symbotic and Berkshire Gray to keep up with execution speeds.

Asia-Pacific (material scale): the fastest growing region. China is the world’s robotics hardware factory, producing cost-effective weapons and AGVs. South Korea and Japan are leaders in adopting robotic order picking to mitigate the “aging workforce” in logistics centers.

Europe (security and groceries): Growth is driven by strict labor laws and high wages. Europe is a pioneer in automated grocery processing (e.g. Ocado in the UK), driving demand for highly sensitive picking systems that handle food without spoiling it.

Market dynamics and strategic outlook

The breakthrough in “eye-hand” coordination: the strategic value no longer resides in the robot arm (basic hardware) but in the “brain” (software). Companies that have the best grip detection algorithms, capable of picking out a shiny object from a chaotic trash can, have the highest stock valuation.

Cobots vs industrial: collaborative robots (Cobots) are gaining ground because they do not require a safety cage. They can work side-by-side with humans, handling the heavy lifting while humans handle the complex exceptions.

Cloud Robotics: “Fleet Learning” is a major trend. If robot A in Chicago learns to choose a new type of shampoo bottle, it uploads this knowledge to the cloud, and robot B in Tokyo also instantly knows how to choose it.

Upgradability: The winners in 2026 are not systems that require building a new warehouse, but those that can “fit in” with an existing facility. This is why mobile manipulators and humanoids are attracting massive investor interest.

Get a copy of this market report: https://marketresearchcorridor.com/request-sample/15879/

Contact us:

Avinash Jain

Market Research Corridor

Telephone: +1 518 250 6491

Email: Sales@marketresearchcorridor.com

Address: Market Research Corridor, B 502, Nisarg Pooja, Wakad, Pune, 411057, India

About Us:

Market Research Corridor is a global market research and management consulting firm serving businesses, nonprofit organizations, universities and government agencies. Our goal is to work with organizations to achieve continuous strategic improvement and achieve their growth objectives. Our industry research reports are designed to provide quantifiable insights combined with key industry insights. Our goal is to provide our clients with the data they need to drive sustainable organizational development.

This version was published on openPR.