Jan 9 (Reuters) – Andreessen Horowitz has raised more than $15 billion across five new funds, the venture capital giant said on Friday, as investor appetite for technology startups grows with the rapid adoption of artificial intelligence.

Andreessen Horowitz, also known as a16z, raised $6.75 billion for a fund aimed at growing startups, $1.7 billion for an AI infrastructure fund and $1.12 billion for another focused on investing in national interests like defense, housing and the supply chain, it said.

The fundraising, the company’s largest ever, represented more than 18% of all venture capital dollars allocated in the United States in 2025, a16z said in a blog post.

Investment in technology and AI-related companies has increased in recent years amid a boom in AI, with the United States stepping up efforts to maintain its global technological lead amid growing competition from China.

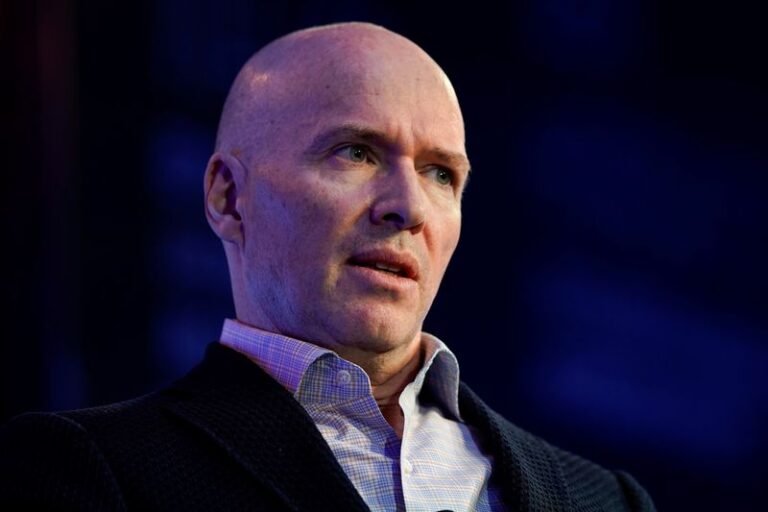

“The technology landscape we will be investing in is…extremely competitive with China…In this moment of profound technological opportunity, it is fundamentally important for humanity that America wins,” said Ben Horowitz, co-founder and general partner of a16z.

A16z was looking to raise a megafund of around $20 billion for growth-stage investments focused on AI, Reuters exclusively reported last April. In October, the Financial Times reported that the company was targeting $10 billion for its next wave of technology investments.

It is one of Silicon Valley’s largest venture capital firms and has backed industry giants such as Facebook, Instagram, Coinbase and Lyft, making it a key force behind US global dominance. technology companies.

In its last major fundraising in April 2024, a16z raised $7.2 billion across five different funds. The firm currently manages more than $90 billion in assets across all its funds.

(Reporting by Deborah Sophia in Bangalore and Krystal Hu in San Francisco; editing by Leroy Leo)