The transaction involves Blackstone investing between $50 million and $75 million in the first tranche for a significant stake, with terms that allow it to increase its stake to a controlling position in Neysa by meeting certain agreed business milestones, the sources said on condition of anonymity.

The deal values Neysa at around $300 million, the sources said. They did not reveal how much stake Blackstone would get initially.

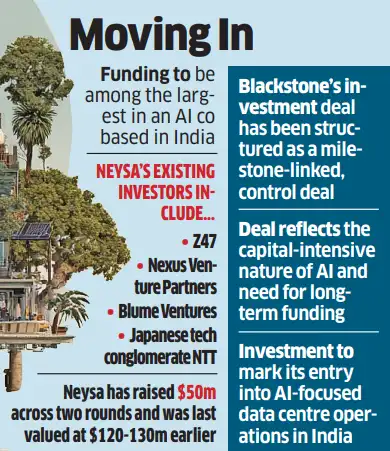

The funding will be among the largest for an India-based AI company and significant for Blackstone, one of the world’s largest real estate owners and operators.

“Neysa has signed an agreement with Blackstone for what looks like a multi-tiered structured transaction,” said a person with knowledge of the negotiations. “Blackstone’s backing will give the AI startup an advantage when seeking to close deals with customers…”

ETtech

ETtech

Neysa’s existing investors include Z47 (formerly Matrix Partners India), Nexus Venture Partners, Blume Ventures and Japanese technology conglomerate NTT. So far, it has raised $50 million in two rounds and its last valuation was $120-130 million.

Unlike traditional venture capital rounds, Blackstone’s investment was structured as a milestone-linked control deal, reflecting the capital-intensive nature of AI infrastructure and the need for long-term funding. Masayoshi Son’s SoftBank was also in talks with Neysa for a growth investment check, people familiar with the matter said, but the Japanese investor was not among the participants in the latest round.

Blackstone did not respond to ET’s queries. Responding to a question, a spokesperson for Neysa said: “The details currently shared are materially and substantially inaccurate and are far from the facts.”

ET reported on December 3 that the Silicon Valley venture capital fund Lightspeed Venture Partners had also joined for a stake in Neysa as the sector prepares for exposure to India’s emerging AI-focused cloud infrastructure platforms.

Neysa is the second venture of Sanghi, who founded Netmagic, one of the oldest data center services companies in India.

Launched in 2023 by Sanghi and former Netmagic executive Anindya Das, Neysa offers computing power and software tools to build, run and manage artificial intelligence (AI) applications to companies ranging from large enterprises to startups and even government clients.

The company operates in the GPU (graphics processing unit)-led cloud and AI infrastructure segment, providing enterprises with compute capacity to deploy artificial intelligence work at scale.

In a recent interview with ET, Sanghi said that AI adoption is expected to evolve decisively. from pilot projects to production environments in 2026, as businesses gain confidence in use cases and look to expand deployment across their core operations.

Blackstone’s Data Center Game

Blackstone’s investment in Neysa will mark its entry into AI-driven data center operations in India, one of the people cited above said. Once the deal closes, the company will be established as a new data center platform for the Sanghi-led PE company.

Blackstone, which has been bullish on AI and data centers globally, currently has a joint venture in India with Panchshil Realty – Lumina Cloudinfra – which is building physical infrastructure for data centers. This investment is part of the private equity firm’s real estate portfolio.

Blackstone manages around $50 billion in assets in India. In an October investor call, Blackstone Vice Chairman and CFO Michael Chae listed data centers as one of the company’s three “highest conviction sectors,” along with logistics and rental housing. These three sectors represent about 75% of Blackstone’s global equity portfolio, Chae said at the time.

The Bloomberg news agency first spoke about Blackstone and SoftBank in talks to invest in Neysa.

So-called hyperscalers (cloud providers) and Indian conglomerates are expected to jointly invest more than $50 billion in India’s data center sector over the next five to seven years. These include commitments from multinationals such as Google, Amazon Web Services, Microsoft Azure and Meta, as well as Indian groups such as Adani, Bharti Airtel, Trusted Industries, Tata Consulting Servicesand Larsen & Toubro.

The government’s national data center policy has proposed a 20-year tax holiday whether operators achieve key milestones related to increased capacity, energy consumption and job creation. It also provides for the categorization of data centers as “essential services” and the creation of economic zones for data centers.

This policy, which is still at the project stage, should stimulate demand once implemented. States such as Karnataka, Uttar Pradesh, Odisha and Tamil Nadu have also started implementing their own policies.