OTTAWA COUNTY, MI — Declining spending among low- and middle-income earners is having a negative effect on Ottawa County’s manufacturing sector.

Meanwhile, on the national stage, rapid investments in data centers are offsetting losses caused by President Donald Trump’s tariff war.

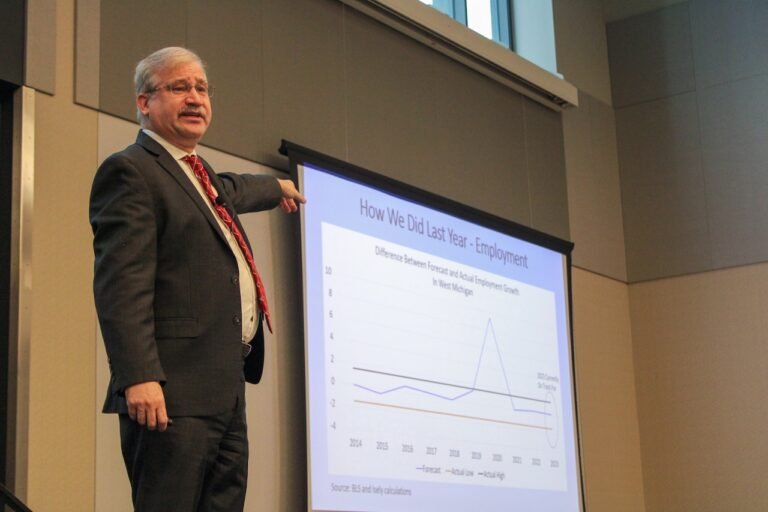

This week, economist Paul Isely presented his findings and forecasts for 2026 at the West Coast Michigan Chamber of Commerce’s annual economic forecast at Engedi Church in the Netherlands.

An associate dean and professor of economics at Grand Valley State University’s Seidman College of Business, Isely frequently gives presentations, such as Tuesday, Jan. 13, to business and economic groups on West Michigan’s economy and its relationship to the national and state economies.

Consumer spending trends

While people in the top 30% of income earners are spending as they normally would, consumer spending has slowed for the bottom 70%. However, instead of placing the blame entirely on inflation, Isely pointed to heightened consumer expectations brought on by increased spending, or “revenge spending,” that followed COVID-19 shutdowns.

“Revenues between 2018 and today, even in Ottawa County, have grown faster than inflation,” he said. “The reason we’re unhappy is because we’ve reset the level of consumption that was normal, and we can’t afford that.”

The fact that the bottom 70% of consumers are becoming more price sensitive is having a negative ripple effect on the manufacturing sector, which is particularly concerning for Ottawa County as a manufacturing hub, Isely said.

Growth and job losses

According to data from the U.S. Bureau of Labor Statistics, 35% of jobs and 44% of wages in Ottawa County come from the manufacturing sector. In comparison, food service, retail, health care and construction account for just 34% of jobs and 22% of wages in the county.

Ottawa County also lost about 2,500 manufacturing jobs between 2024 and 2025. This is partly due to automation, but also due to the auto industry moving away from electric vehicle production.

The automotive industry creates a lot of wealth in Ottawa County, with parts manufacturers like Gentex being one of the area’s largest employers, but due to political conflicts between electric vehicles and internal combustion engines, this industry is also very volatile.

“If you’re in the internal combustion engine, you’re not hurting, but you probably don’t want to make a lot of additional investment because you’re not sure it’s going to be there in three years,” Isely said.

Ottawa County has maintained roughly the same number of jobs from year to year by replacing those higher-paying manufacturing jobs with lower-paying jobs in food and hospitality services, Isely said.

The rate of new orders also declined significantly in West Michigan during the second half of 2025. Manufacturers began the year optimistically as they were certain of the shift to internal combustion engines, but that optimism was tempered once the effect of Trump’s tariffs began to be felt in the second half of the summer, Isely said.

“It worries us a little bit at the moment,” he said.

Outlook for 2026

Rates were the top question for employers in early 2025, but new state laws regarding minimum wage and paid sick leave have also created some uncertainty.

Governor Gretchen Whitmer in February 2025 sign signed into law two bills changing the state’s minimum wage, tip credit and sick leave law after state lawmakers approved a last-minute compromise.

Under the new wage law, the minimum wage will increase to $15 by 2027, with increases each year tied to inflation. The first increase was scheduled for February 21, 2025, with pay increasing from $10.56 per hour to $12.48.

The new sick leave law required businesses with fewer than 11 employees to provide 40 hours of paid sick leave beginning October 1, 2025. Businesses with 11 or more employees were required to provide 72 hours of paid sick leave immediately upon signing.

In a recent survey of Ottawa County employers, 27% of respondents said the new sick leave law had negatively impacted businesses, while only 8% said the new minimum wage law had harmed them, Isely said.

“We didn’t expect minimum wage to be a big deal because wages were already above minimum wage,” Isely said. “We really expect that the minimum wage increase next year will be the one that starts to affect businesses, as opposed to this year or last year.”

A slim majority (53%) said some state or federal policies have had a negative impact on businesses, whether it’s wages, sick leave or tariffs.

Business confidence for the new year is up significantly compared to last year, with 72% of respondents saying they are optimistic for 2026, compared to 67% at the start of 2025.

Sales growth expectations also stand at 3.1% for 2026, up from 2.4% in 2025.

Employers, however, remain uncertain about the future, which is reflected in slowing job growth, Isely said.

“What we hear from companies is, ‘I’m starting to sell more products, but I’m not willing to invest in people because I don’t want to increase my cost structure,'” he said.

Continued investments in artificial intelligence

According to national and local surveys, about 60% of companies reported using AI to improve productivity, while only 10% said they were using AI to reduce their workforce, Isely said.

AI-related job losses are expected to increase in the second half of 2026, primarily driven by AI training in the insurance and financial sectors.

“A lot of these models will be ready for prime time this summer,” Isely said.

Investments in data centers are also expected to continue this year, he said. While the general public remains pessimistic about large companies grabbing land to build huge data centers, Isely warned that the United States would already be in recession without these massive investments.

While Trump’s tariffs cost the U.S. economy about $350 billion, the largest tech companies spent about $350 billion on data center capital expenditures, completely offsetting the loss from the tariffs, Isely said.

“President Trump is the luckiest man on the planet,” he said. “But it had the effect of sucking all that economic growth out of a very small sector of the economy.”

That data center surge might look good for employees’ 401(k)s right now, but rapid growth in such a small sector could put the stock market in a situation similar to the stock market crash of the 1990s, Isely predicted.