Corporate investors sharply increased the number of startup funding rounds they backed in November 2025 compared to the same month last year, as areas such as robotics, autonomous and electric vehicles, renewable energy and personal finance came into focus.

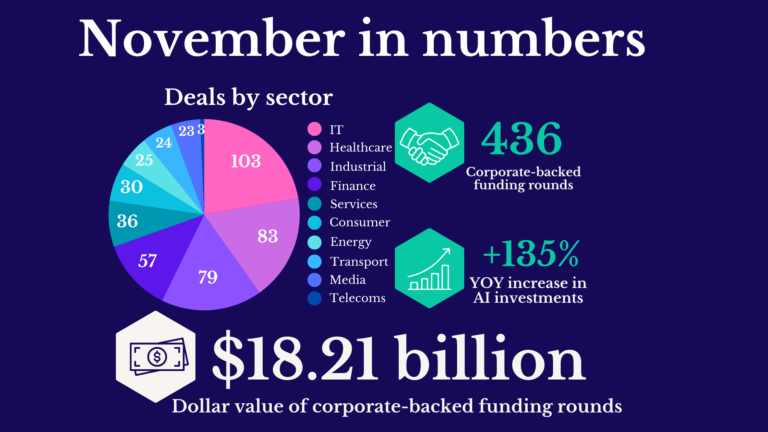

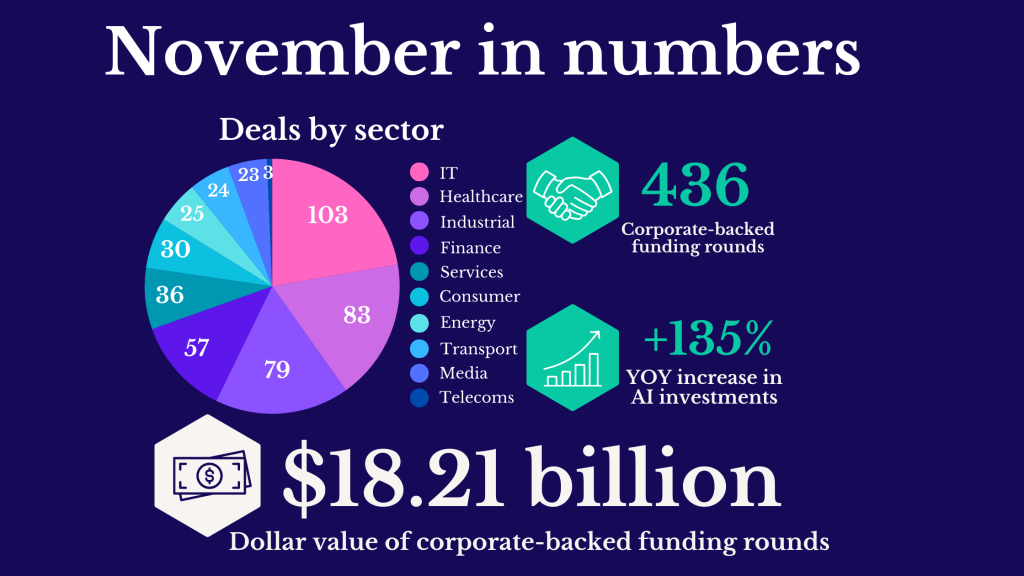

The number of corporate-backed deals rose 47% to 463 in November from last year, part of a general upward trend in investment activity this year.

Investments in AI startups increased by 135%, robotics and unmanned aerial vehicles by 108%, and even enterprise software startups saw a 167% increase in venture-backed funding rounds. Personal finance has more than tripled year over year, as has renewable energy.

Connected and autonomous vehicles, as well as care delivery and on-demand services, both saw transactions double that of November last year.

Many of them were nine-figure series, including robotic automation software provider Physical Intelligence, embodied intelligence technology developer Roboterra, physical AI technology developer NestAI, autonomous driving technology developer Forterra and autonomous electric delivery vehicle maker Harbinger.

The subsectors more than doubled year-over-year and benefited from investments from companies like FedEx, Coca-Cola, Alphabet, Nvidia, Nokia, Hitachi, CHA Biotech, TSE Energie and many others.