HVAC teams are increasingly navigating a minefield of overvalued AI startups as they seek to invest in transformative technology.

Talk of an artificial intelligence bubble is getting louder by the day. Commentators warn that the exuberance surrounding the technology is starting to resemble fads of the past and that a reckoning may not be far away.

The concern is not unfounded. The amounts invested in AI are enormous. In 2025 alone, Microsoft, Alphabet, Amazon and Meta will spend more than $300 billion to build data centers, buy chips and expand their computing capacity. Some hyperscalers, such as Meta, Amazon and Oracle, have turned to debt markets to finance their expansion, raising fears that a sharp correction could ripple through the entire financial system, even though most big tech companies have strong balance sheets.

Yet, despite these risks, corporate investors show no signs of backing down. For many, the fear of missing out on a fundamental technology outweighs the risk of paying too much. They say AI is not just another software cycle, but a general-purpose technology that will reshape entire industries.

A company invested in several of last year’s biggest AI fundings says pulling out now would be a mistake.

“We believe AI will redefine the way we work and generate long-term value far beyond short-term gains. In our view, the real risk lies not in investing too much but in falling behind by investing too little,” said the investor, who asked to remain anonymous.

“The companies that will thrive are those that are ready to make bold, meaningful commitments to AI. Right now, the industry is at a pivotal moment in AI investment, and taking a forward-looking approach is a smart strategic move for the future.”

Even a 5% chance of achieving a hundred billion dollar result can reasonably support a valuation of five billion dollars, the investor adds.

Tech companies fuel the investment bubble

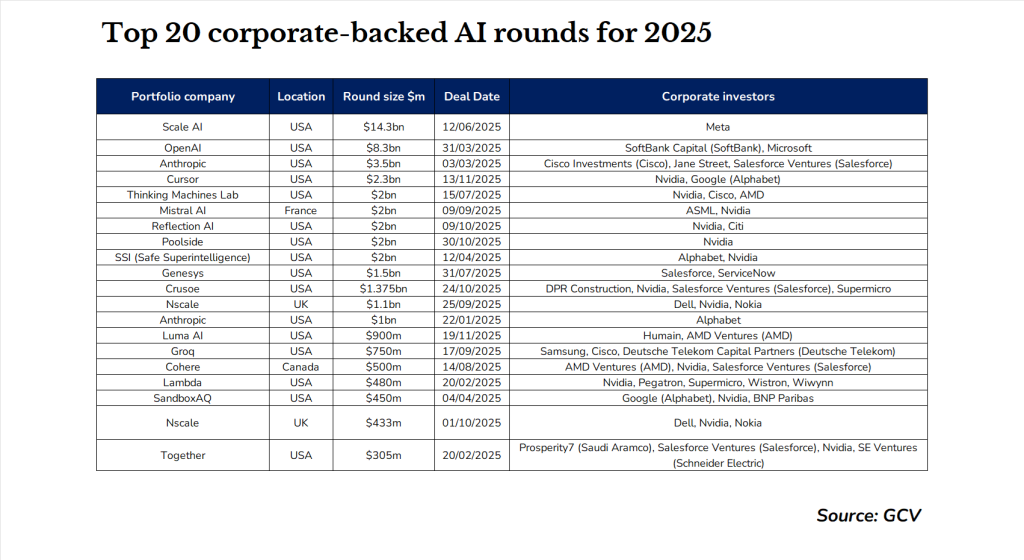

Tech giants have helped fuel this dynamic. Meta, Microsoft, Nvidia and Alphabet featured prominently in many of the largest AI funding rounds of the last year. Nvidia alone has backed dozens of startups, using its dominance in AI chips to secure early exposure to companies building on its hardware.

However, not all corporate investors are willing to chase every deal. Some are becoming more selective, wary of valuations that seem detached from commercial reality.

“Where I see overvaluation is in software and, to some extent, hardware,” says Yvonne Lutsch, chief investment officer of Lam Capital, the HVAC arm of Lam Research, a supplier of semiconductor processing equipment. “I tend to believe that for many companies, it can still be profitable. But in software, the valuations of some of these companies are really, really high. And if the valuations of early-stage hardware companies are over $500 million, I’m naturally skeptical.”

The scale of potential losses also worries some investors. Compared to previous technology cycles, far more capital is now at risk. A correction, if it comes, could therefore be more painful. “The amount of money that can go to zero overnight is much higher. If a market correction appears, the greater the losses and the impact will be very significant,” notes Lutsch.

Despite everything, the AI boom has allowed founders with a solid reputation to raise huge sums of money before producing a commercial product. A good example of this is the $2 billion funding round raised last year by former OpenAI CTO Mira Murati for her new company.

This dynamic leaves many corporate investors looking sideways at closing the biggest deals.

Avoid the hype

However, there are still some AI startups that are not overvalued and can demonstrate revenue from an existing product, Lutsch says.

“There are AI companies that have built something, they have revenue and their valuation is not based on their name or reputation. Their valuation is based on the short-term revenue they can generate. These companies are valued like ‘normal’ startups and that is a good space to invest in. We are participating in the growth of AI and not the hype,” she says.

Lam Capital’s parent company has benefited from the AI rush because it is a supplier to the semiconductor industry that is building the infrastructure to power the technology. CVC invests in the semiconductor, AI chip and industry 4.0 technology sub-sectors.

“As a venture capital firm, we act in accordance with our corporate culture – humble and agile. We do not see ourselves in the role of spending billions investing in startups. But we still want to invest in the field of AI, as well as in software that allows us to create better products and make our business more efficient,” says Lutsch.

Lam Capital’s AI investments include eBots, a maker of robots capable of automating labor-intensive manufacturing, and Corvic, an AI generative business intelligence software.

Others see early signs of a cooling market. Sean Wright of JLL Spark Global Ventures notes that some AI companies are now struggling to raise money on the terms they expected.

“Some valuations are going down. Some AI companies aren’t necessarily getting funded or aren’t getting funded on the terms they thought they were going to get,” Wright said at the GCV Connect: Germany event in October.

Most tech booms end with the failure of a large number of companies and the emergence of a smaller group of sustainable winners, who can become extremely valuable. For corporate investors, the challenge is to distinguish between the two.

“We look for situations where there is real value for us, where we can see it through our expertise, where we can see it applying to our business or our customers, and where we think we have a better understanding because we can tangibly see the value and how it’s going to materialize,” Wright said.

Recent AI investments made by the JLL Spark team include Jeeva AI, an agentic AI software that generates leads; Acelab, an AI-powered platform for managing workflows in the construction industry; and Qbiq, software that automates architectural planning.

Many innovations still need to emerge to fuel the AI revolution and CVCs have a unique role to play in reducing the risks associated with this technology, says Nicolas Sauvage, president of TDK Ventures, the VC arm of Japanese electronics manufacturer TDK.

Innovations in energy generation and storage, transmission, computing and connectivity will all be needed to create a sustainable way to deploy AI. “We can expect a huge amount of innovation,” Sauvage told GCV. “I don’t think it’s a bubble in terms of the level of innovations we’ll see in the next few years.”