(Bloomberg)– Meta Platforms Inc. has agreed to buy Manus, a popular Singapore-based artificial intelligence agent of Chinese origin, as part of its efforts to build a business around its massive investment in AI.

The deal values Manus at more than $2 billion, according to people familiar with the matter. It’s a rare U.S. acquisition of an Asian tech company and the latest multibillion-dollar bet on AI from Meta CEO Mark Zuckerberg. The deal was concluded in about 10 days, the sources said, speaking on condition of anonymity because the details are not public.

Most read on Bloomberg

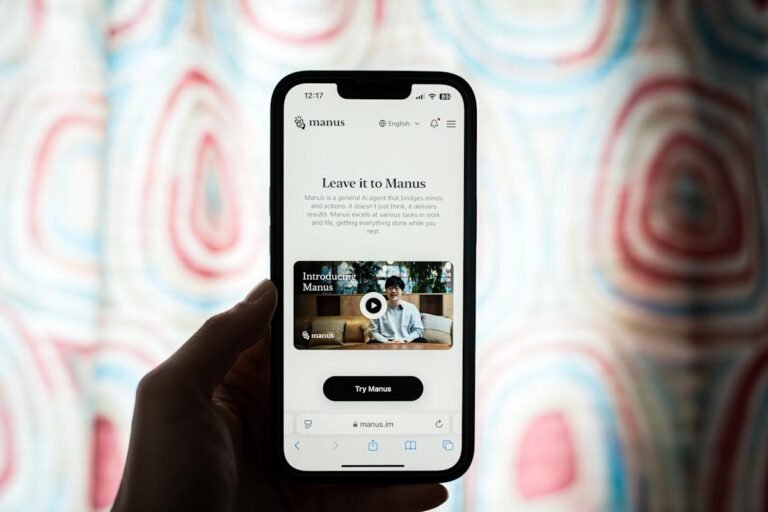

Meta intends to continue to operate and sell the Manus service while integrating the technology into its products, it said in a statement. Backed by some of China’s biggest names, including Tencent Holdings Ltd., ZhenFund and HSG, Manus rose to prominence earlier this year, shortly after DeepSeek’s debut. All of its existing investors were bought out in the Meta buyout, one of the sources said. It’s unclear whether severing ties with China will ease the government’s concerns at a time when the Asian nation and the United States are vying for dominance in AI.

“There will be no further Chinese participation in Manus AI following the transaction, and Manus AI will cease its services and operations in China,” a Meta spokesperson said. Manus’ parent company, Butterfly Effect Pte, was founded in China before moving to Singapore.

Zuckerberg has made AI his company’s top priority and is spending billions to hire researchers, build data centers and develop new models. Manus earned $125 million in annual revenue earlier this year from selling its AI agent to businesses via subscriptions, which could give Meta a more immediate return on some of its AI spending.

The Manus AI agent can perform a handful of general tasks, such as checking resumes, creating travel itineraries, and scanning inventory in response to basic instructions. Butterfly Effect raised funding earlier this year at a valuation of nearly $500 million in an investment round led by US venture capital firm Benchmark.

What Bloomberg Intelligence says

Meta’s purchase of Manus is likely aimed at expanding the former’s AI agent task capabilities, as it currently lacks apps built on its own core model compared to a broader app ecosystem for ChatGPT, Google Gemini, and Anthropic Claude. While the deal marks a first step for Meta in building a subscription and API business around its AI investment, it could face regulatory scrutiny given that Singapore-based Manus was founded in China.

— Mandeep Singh and Robert Biggar, BI analysts

AI agents are tools that do not require human supervision to perform specific digital tasks. Enterprise software companies such as Salesforce Inc. and ServiceNow Inc. have heavily promoted their versions of agents as the most effective way for businesses to use emerging technology, rather than generative AI features such as chatbots, which require prompts and user interaction.

Meta already has an AI chatbot, Meta AI, which is available on the company’s social media and messaging platforms – Facebook, Instagram and WhatsApp – in addition to its AI glasses. The US company is acquiring Manus’ technology and leadership group, although its statement did not specify where the new team will sit within the organization. The Wall Street Journal, which previously reported on the deal’s value, said Manus co-founder and CEO Xiao Hong would report to Javier Olivan, Meta’s chief operating officer, citing people familiar with the matter.

Alexandr Wang, Meta’s chief AI officer who joined this summer as part of a high-profile investment in his startup, welcomed Manus’ team of about 100 people with a message about X. In his own message on the platform, Manus’ Xiao said the deal would help his company expand the reach of its agents. “The era of AI that doesn’t just talk, but acts, creates and delivers, is only beginning,” he wrote. “And now we can build it on a scale we could never have imagined.”

Meta’s aggressive spending to compete in the AI race is matched by rivals like OpenAI, Alphabet Inc.’s Google and Microsoft Corp. Zuckerberg has pledged to spend $600 billion on U.S. infrastructure projects over the next three years, many of which are expected to be related to AI. The company has hired an expensive team of researchers to develop a new cutting-edge AI model that it plans to launch next spring, and has faced some skepticism from investors who fear the heavy spending won’t generate significant revenue in the near future.

Venture capital firm Benchmark came under fire earlier this year from lawmakers and other venture capitalists for backing an AI company with ties to China. “Who thinks it’s a good idea for American investors to subsidize our biggest AI adversary, only to have the CCP use that technology to challenge us economically and militarily? Not me,” wrote U.S. Senator John Cornyn, a Republican from Texas, in an article on X in May. Benchmark did not immediately respond to a request for comment on the Meta deal on Monday.

Asked about the deal at a regular news briefing, a Chinese Foreign Ministry spokesperson on Tuesday referred reporters to relevant regulatory agencies, without providing further details.

–With the help of Vlad Savov and Philip Glamann.

(Updates with US-China context in third paragraph)

Most read from Bloomberg Businessweek

©2025 Bloomberg LP