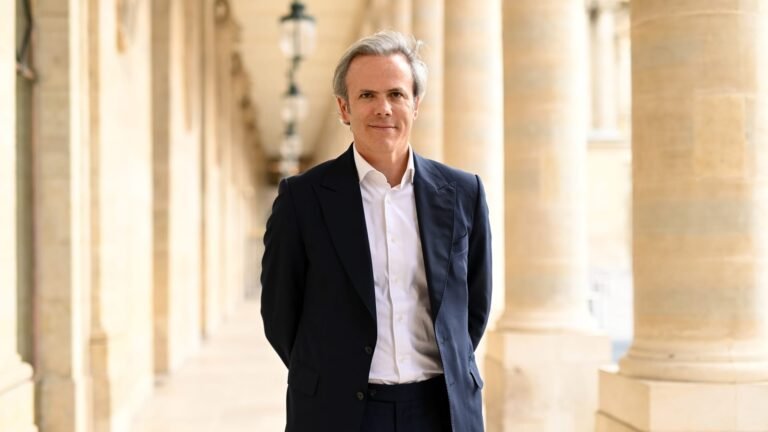

Guillaume Houze attends the 33rd ANDAM Prize winners’ cocktail at the Jardins du Palais Royal on June 30, 2022 in Paris, France.

Pascal Le Ségrétain | Getty Images Entertainment | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide for wealthy investors and consumers. Register to receive future editions, straight to your inbox.

The top 10 family offices for startup investments have made more than 150 investments combined this year, in everything from biotechnology and energy to crypto and artificial intelligence, according to a new analysis.

CNBC partnered with Fintrx, the private wealth intelligence platform, to analyze the single family offices that made the highest number of investments in private startups in 2024. The list, the first of its kind, highlights spotlight investments from some of the biggest names in the industry. family offices, from Bernard Arnault’s Aglaé Ventures to Laurene Powell Jobs’ Emerson Collective and Peter Thiel’s Thiel Capital. It also reveals names that are little known outside the secretive world of family offices – the private investment arms of wealthy families – but have become major players in the world of venture capital and private markets.

The most active family office so far this year is Maelstrom, the Hong Kong-based family office of American investor Arthur Hayes, co-founder of crypto exchange BitMEX. Maelstrom has invested in 22 private startups this year, according to Fintrx data, surpassing all other family offices in the database. The vast majority of Maelstrom’s investments are in blockchain technology, including Cytonic, Magma, Infinit, Solayer, BSX, Khalani and Term Labs.

In second place in the Top 10 is Motier Ventures, the family office and venture capital arm of Guillaume Houzé. Houzé, scion of the legendary French dynasty that owned Galeries Lafayette and other retail giants, co-founded Motier in 2021 to invest in tech startups.

Motier has invested in 21 startups so far this year. Its investments are largely in artificial intelligence and blockchain, but also include publishing and advertising. Investments include Vibe.co, known as the “Google Ads of streaming”; Adaptive, a technology platform for the construction sector; and PayFlows, a financial technology company. This was part of a $220 million seed funding round for Holistic AI, a French generative AI startup, and a $30 million funding round for Flex AI, a digital computing company. AI based in Paris.

Motier also participated in two fundraising rounds for Mistral, the fast-growing French AI company, which raised more than $500 million last year and whose investors include Nvidia, Lightspeed and Andreesen Horowitz.

Tied for third place are Atinum Investment, the Seoul, Korea-based family office for an unknown family that has primarily invested in software and AI; Hillspire, the family office of former Google CEO Eric Schmidt; and Emerson Collective.

Thiel Capital, tied for sixth place, invested in Fantasy Chess, founded by 17-time world chess champion Magnus Carlsen, as well as Rhea Fertility, a Singapore-based fertility clinic company.

The list does not include investment amounts and may not include all transactions or all family offices, as they are not required to disclose their investments. Fintrx compiles its data from public and private sources from its team of researchers. For the purposes of the list, family offices are defined as investment vehicles or holding companies of a single family or individual that do not manage money for outside investors. Investments do not include real estate.

Taken together, the rankings provide a rare window into the growing power of family offices in the world of startup capital, as they grow in size, wealth and deal sophistication. Nearly a third of startup capital in 2022 came from family offices, according to a PWC report.

AI has become their preferred investment theme for 2024, and will likely be again in 2025. According to the UBS Global Family Office report, AI is now the preferred investment category for family offices. More than three-quarters, or 78%, of family offices surveyed plan to invest in AI over the next two to three years – the highest figure of any category. Like CNBC did previously reportedAglaé Ventures, the tech venture arm of the family office of LVMH boss Arnault, has made a series of investments in AI this year. Jeff BezosBezos Expeditions has also made several bets on AI in 2024.

Family office advisors say serial investors like those in the Top 10 often treat startups as think tanks, where they can learn about cutting-edge technologies and markets. They can apply this knowledge to larger investments or their own businesses.

Schmidt’s family office, Hillspire, for example, has made more than a half-dozen investments this year in AI, which has also helped inform its big bets on energy companies, given the need for energy of computer AI. Hillspire participated in the $900 million investment round for Pacific Fusion, a nuclear fusion startup, as well as Sion Power.

While a large number of family offices invest in tech startups through venture capital funds, the deals on the CNBC list involve investments made directly by family offices in startups.

The largest family offices, such as Hillspire, Thiel or Aglaé, have growing teams of transaction and technology experts capable of analyzing investments and valuations. Smaller family offices and those that don’t specialize in tech startups typically invest through a venture capital fund. One of the biggest trends in family offices is “co-investment,” meaning a venture capital fund takes the lead on an investment and the family office invests as a partner, often with lower fees.

Nico Mizrahi, co-founder and general partner of Pattern Ventures, which acts as a fund of funds for emerging managers and works with family offices, said there are growing risks for family offices trying to invest on their own in technology startups. After the stock market declines of 2022 and early 2023, which also caused the valuations of many private technology companies to fall, paper losses are piling up in the private technology market. The absence of private equity IPOs, mergers and acquisitions has also led to fewer outflows, thereby tying up liquidity.

“Some family offices weren’t as disciplined and were drinking the Kool-Aid,” Mizrahi said. “I think they’ve overextended themselves and become a little too eager to chase the venture capital wave. There will be recaps; there will be companies that disappear.”

Mizrahi said the best strategy, especially for small family offices, is to team up with experienced managers with expertise in tech startups.

“It’s really hard to get the best deals and generate the best returns when you’re not doing something full time with 100 percent of your attention,” he said. “You really have to do it with a partner, companies that do it all day, networking and doing due diligence, background checks and references.”