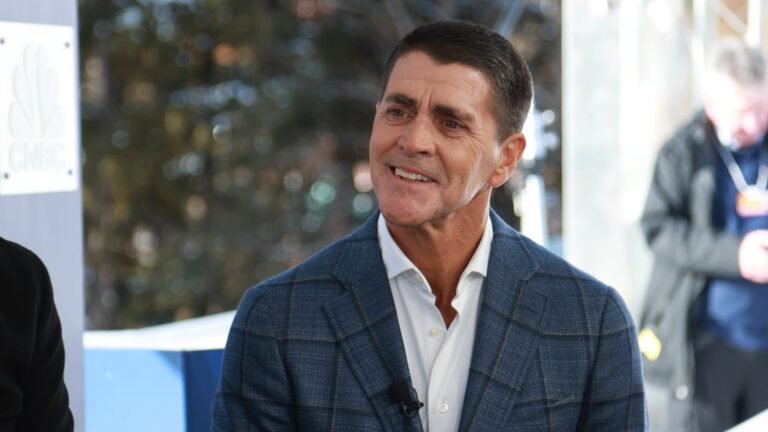

working day CEO Carl Eschenbach tried Thursday to allay concerns that artificial intelligence destroys software business models.

“It’s an exaggerated narrative, and it’s not true,” he told CNBC’s “Squawk Box” from the 2014 World Economic Forum. DavosSwitzerland, calling AI a tailwind and “absolutely no headwind” for the company.

Software stocks have sold off in recent months on concerns that new AI tools could upend the industry and replace long-standing, recurring businesses that once generated big profits.

Workday shares lost 17% last year and are down another 15% since the start of 2026.third quarter earnings reportthe company shared lackluster subscription revenue forecasts that spooked some analysts and investors.

Elsewhere, Adobe And Sales force lost 21% last year, while HubSpot fell by more than 40%.

Eschenbach said businesses rely on Workday to benefit from more AI tools and proprietary data, which the company leverages to stay ahead of third-party tools.

Many software companies have invested in more tools to strengthen their AI software stacks and anticipate competitive pressures in AI.

Working day reduced by approximately 1,750 jobs last year to invest in AI and ServiceNow signed a three-year contract manage OpenAI earlier this week to bolster its offerings.

“We are in a unique position to be one of the AI winners in the enterprise because of our established position and, ultimately, because of the trust we receive from our customers,” Eschenbach said.

WATCH: Sierra CEO Bret Taylor on the future of AI: We’re at the beginning of the curve