More than $1 billion has been spent on AI-native startups. Fintech, biotech/medtech and climate tech startups were also winners in 2025, according to the latest report from Cut Through Venture and Folklore Ventures.

Key takeaways

- Australian startups raised $5.1 billion across 390 deals in 2025, up 24% year-on-year, making it the third largest funding year on record.

- Funding surged at the end of the year, with $2 billion raised in the fourth quarter alone, the strongest quarter since 2021.

- AI has been the biggest driver, with over $1 billion going to AI-native startups and 61% of total funding coming from companies using AI.

- The largest funding rounds dominated the year, with the 20 largest deals accounting for 58% of total funding.

- Fintech raked in $868 million, while hardware, robotics and IoT attracted $297 million.

- Seed-stage deal size remained strong, with pre-seed medians exceeding $1 million and funding rounds approaching $3 million.

Large number

2 billion dollars – The amount raised by Australian startups in the last quarter of 2025 alone, marking the strongest quarterly funding result since 2021.

Crucial quote

“What excites me as we approach 2026 is that the market appears to be in a unique state of rapid evolution without being irrational. Investments are happening at a rapid pace, but the bar remains high, and this combination should produce healthier companies,” says Chris Gillings, founder of Cut Through Venture and managing director of Five V Capital.

“Liquidity at scale remains the missing ingredient. Deployment has returned with pace and conviction, now the ecosystem needs exits and provision of liquidity to constrained partners.”

Key context

Some 390 deals took place in the Australian startup ecosystem in 2025, an increase of 24% from the previous year. More than $5 billion has been committed to move from investors to founders of AI-native fintech, biotech and climate technology companies, making this the third largest year of funding on record.

“2025 ended on a high, delivering one of the strongest quarters of funding announcements since 2021 and signaling that confidence has returned to Australian venture capital,” says Chris Gillings, founder of Cut Through Venture and managing director of Five V Capital.

Sixty-one percent of total funding went to companies integrating AI.

“The AI wave has acted as an accelerator, not because ‘AI’ sells, but because it reduces time. Teams can ship, iterate, and prove their value faster, which has allowed more companies to get to a fundable position sooner.”

The final quarter of 2025 accounted for 40% of the year’s funding, according to the State of Startup Funding report. Hardware, robotics and IOT attracted $297 million in funding, and fintech $868 million. Media, crypto and EdTech startups had a harder time securing funding, the report said.

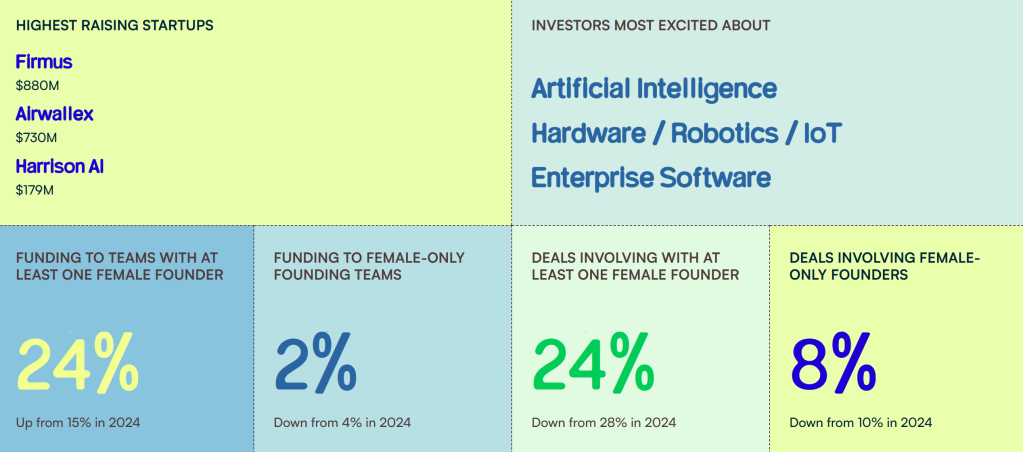

The share of funding going to female founders did not increase last year, with only 24 percent of deals going to female-led companies, compared to 28 percent in 2024. All women’s teams attracted only 2 percent, compared to 4 percent the year before.

4% drop in funding for female founders

“Capital gains were the result of a small number of large cycles rather than an increase in capital.

number of teams funded,” the report states.

“A limited group of female and mixed teams accounted for the majority of capital raised by women-led startups. As a result, many founders experienced little change on the ground despite better overall results. The data indicates concentration, not systemic change,” the report said.

Rachel Yang is a partner at venture capital firm Giant Leap. She drew a line between the reluctance of DEI in the US and the state of funding for female-founded startups in Australia.

“A disappointing result heading into International Women’s Day, but not unexpected. When the conversation dies down, as it has over the past 12 months, progress slips,” Yang said. Forbes Australia.

“I believe the DEI backlash in the US is also important here. The withdrawal has direct effects, including missed returns on women-led businesses.”

Yang also raised concerns that women’s voices are being sidelined throughout the AI transformation.

“This is especially important as AI is rapidly reshaping industries. If women’s voices are missing among those building and supporting this technology, we find ourselves in the same blind spots on a large scale,” says Yang.

The opportunities exist and the founders are ready. What is missing is sustained market confidence. This is why we must continue to talk about it more, not less.

Startups with at least one female founder absorbed 24 percent of total funding in 2025, up from 15 percent in 2024 – even as the share of deals involving a female founder fell to 24 percent, from 28 percent.

International investments have also seen a slight increase, with 66% of transactions completed in 2025 including at least one foreign financier. Fifty-seven percent of transactions completed in 2024 involved an international investor.

“While the weight of capital is typically spread across larger, later rounds, investment activity in 2025 has been largely distributed across stages and sectors receiving capital,” says Alister Coleman, founder and managing partner of Folklore Ventures.

“As a nation, we must ensure that the bold visions of our founders are not crushed or watered down.

or taken for granted. Australia has an incredible talent pool of ambitious founders with big ideas and quality operators who can bring those visions to life.

“We must continue to match this opportunity with a financing environment that supports the growth of technology companies and the gains that come from their success. »

Take a look back at the week gone by with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here Or become a member here.