When there is something in the markets that everyone “knows” to be true, it is worth considering the other side of the market.

Since OpenAI’s ChatGPT debuted in November 2022 and ushered in the AI era, the S&P500 increased by 68%. Although primarily fueled by the gains of big tech stocks, many other companies like McDonald’s And Starbucks rallied around expectations that AI-based technologies would increase productivity and expand margins.

However, in this period of time, Adobe (ADBE 2.66%) suffered. Shares of the $112 billion company, which offers creative products for photographers, video editors, graphic and experience designers, game developers, content creators, marketers and more, fell 21% on concerns that AI content creation technologies could make its services obsolete.

Today’s change

(-2.66%) $-7.03

Current price

$257.64

Key Data Points

Market capitalization

$109 billion

Daily scope

$256.93 -$264.05

52 week range

$256.93 -$465.70

Volume

58K

Average flight

4.6 million

Gross margin

88.60%

This year, the selling has intensified, with shares falling 23.5% year to date. The major media are multiplying, with Forbes wondering if Adobe is a “falling knife” as Wall Street companies sold a net 4.8 million shares last quarter.

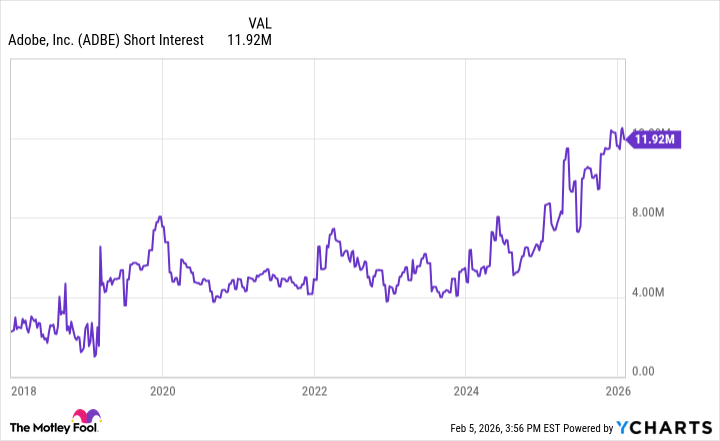

Growing pessimism toward Adobe is reflected in the rise short interest, or the percentage of the company’s stock that was sold short. As you can see, it is easily at its highest level in eight years.

Data by Y charts.

The short sellers may be right. But with bearish sentiment pervasive, I’m reminded of something legendary investor Jim Rogers once said: “When there’s something in the markets that everyone ‘knows’ to be true, it’s time to look at the other side of the coin.”

Based on this advice, I wondered what the Bears were missing – and why Adobe might be a worthwhile buy today.

If Adobe is doomed, why do profits continue to rise?

In its first results conference After ChatGPT took the world by storm, Adobe reported record revenue of $19.41 billion for the just-completed fiscal year and profit growth of 17% year-over-year, with strong numbers in its Creative Cloud, Document Cloud, and Experience Cloud segments.

Image source: Getty Images.

Three years later, Adobe again announced record results for fiscal 2025. Revenue jumped to $23.77 billion, up 11% year-over-year. Net income jumped to $7.13 billion from $5.56 billion in fiscal 2024.

Over the first three reported fiscal years since the AI era began, here’s how Adobe’s revenue, net income and earnings per share performed.

| Fiscal year | Income | Net income | PES | Share repurchases |

|---|---|---|---|---|

| 2022 | $17.61 billion | $4.76 billion | $10.10 | 15.7 million shares |

| 2023 | $19.41 billion | $5.43 billion | $11.82 | 11.5 million shares |

| 2024 | $21.51 billion | $5.56 billion | $12.36 | 17.5 million shares |

| 2025 | $23.77 billion | $7.13 billion | $16.70 | 30.8 million shares |

Data source: Adobe.com.

Looking through each column, it’s striking how the numbers continue to climb, barring a slight slowdown. share buybacks in 2023. Adobe does not pay a dividend, so share repurchases are the way management returns value to shareholders. Its repurchase of more than 70 million shares since 2022 is very significant for a stock that only has 410.5 million shares outstanding.

Meanwhile, as Wall Street speculates that the $15.7 trillion AI revolution will bulldoze Adobe, the company is leaning closely on the technology.

“The biggest opportunity for Adobe in decades”

During the company’s third-quarter earnings conference call last September, CEO Shantanu Narayen called the AI revolution “the biggest opportunity for Adobe in decades.” He highlighted the popularity of the Adobe Experience Platform (AEP) AI Assistant, with 70% of eligible AEP customers using it, and the company’s success in introducing innovative new AI-driven products, with AI already heavily integrated into Adobe’s flagship applications in Creative Cloud.

Since that call, the company released its fourth-quarter earnings report, which expands on Adobe’s adoption of AI across its platforms. One statistic stood out to me: In the fourth quarter, Adobe saw record deals worth over $1 million, while the number of customers paying Adobe $10 million or more in annual recurring revenue increased 25% year over year.

It’s a sign that Adobe’s adoption of AI is paying off and customers are excited about the seemingly fantastic capabilities of its new services. Anything can happen, but as Mark Twain might say, rumors of the death of this company are greatly exaggerated. For investors with a moderate risk tolerance, Adobe is an interesting speculation.